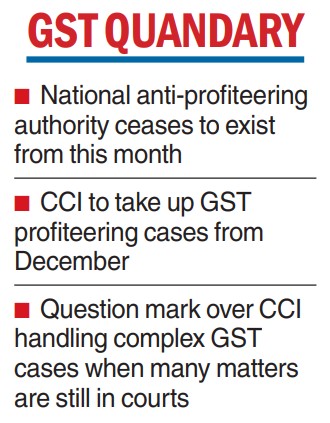

The Competition Commission of India (CCI) will adjudicate on all profiteering matters in GST from December 1 with the term of the National Anti-Profiteering Authority (NAA) ending this month.

But analysts have questioned whether the CII, which handles competition matters, has the competency to handle GST issues even as what constitutes profiteering remains unresolved amid court cases in high courts on the constitutional validity of the anti-profiteering provisions.

A sunset clause that was envisaged for the NAA has been junked by the Centre, the analysts said.

As a market regulator, the CCI ensures the fair discovery of prices through market forces, whereas the NAA mandates the passing of tax benefits and input credits to consumers. There is a lack of synergy in their roles as also a lack of expertise in the CCI in handling tax matters.

In a notification, the finance ministry said: “The central government, on the recommendations of the Goods and Services Tax Council, empowers the Competition Commission of India to examine whether input tax credits availed by any registered person or the reduction in the tax rate have actually resulted in a commensurate reduction in the price of the goods or services or both supplied by him.” The ministry notification shall come into effect from December 1.

The NAA is a profiteering watchdog and was set up after the introduction of the GST, initially for two years, which was extended twice subsequently. In the Lucknow meeting of the GST Council last September, the tenure of the NAA was extended till November 30.

Sanjeev Sachdeva, partner of Luthra and Luthra Law Offices India, said: “The sunset clause that was envisaged for the authority to exist, is now removed. Consequently, anti-profiteering will continue to be around for an unspecified time.”

M.S. Mani, par tner, Deloitte India, said: “The industry would expect some guidelines to aid in the determination of profiteering or otherwise. Ideally, market forces should determine pricing, and a recourse to CCI should be made only in very exceptional cases.”