US President Donald Trump’s tariff threats returned to haunt the stock markets on Monday with the Sensex plunging 824.29 points, wiping out investor wealth worth Rs 9.24 lakh crore.

Uncertainty over the Union budget, tepid corporate earnings, continued FII selling and other events that included the two-day US Federal Reserve meeting, which commences on Tuesday, and forward and options (F&O) expiry also pulled stocks down as investors refrained from taking fresh bets even at lower levels.

While fears about Trump imposing big tariffs had faded in recent sessions, they were reignited when he threatened to impose a 25 per cent tariff on Columbia for their refusal to take back deported illegal migrants.

However, a trade war — Columbia also warned about retaliatory tariffs — was averted after the Latin American nation agreed to receive the migrants.

``A major concern is that President Trump is coming up with new threats like the 25 per cent tariff on Columbia for its refusal to take back deported illegal immigrants. Therefore, will Trump walk his talk on other threats including tariffs on China and other countries, is a question that is being asked in economic and market circles now. These concerns are weighing on the markets,’’ V.K. Vijayakumar, chief investment strategist, Geojit Financial Services said.

``The market is looking forward to fiscal stimulus through income tax cuts in the Budget. If the expectations are met, there can be a relief rally in the market. But if a rally is to sustain, we need data indicating growth and earnings revival,’’ Vijayakumar said.

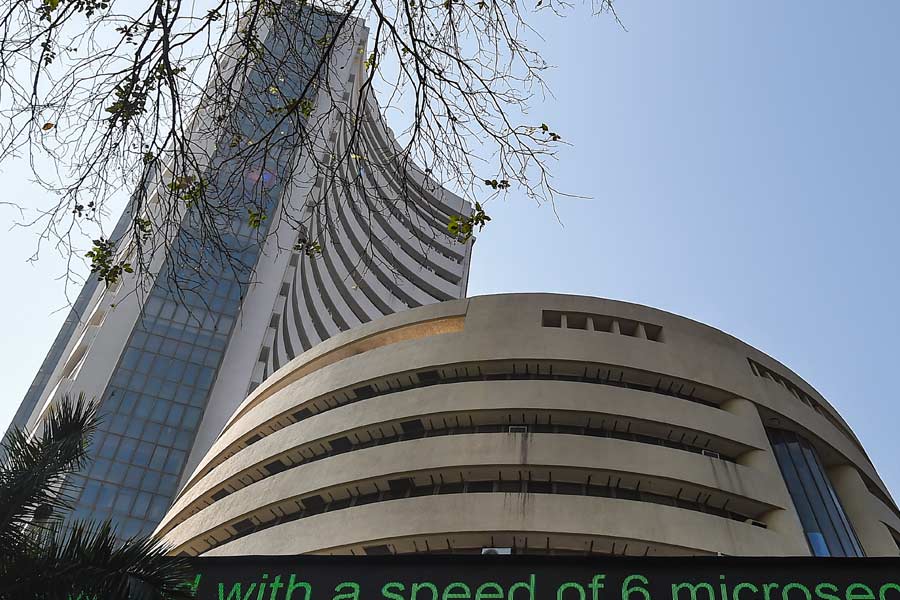

At Dalal Street, the 30-share Sensex opened on a weak note at 75700.43 and plunged 922.87 points to hit a day’s low of 75267.59. It thereafter recovered some ground and closed lower by 824.29 points or 1.08 per cent at 75366.17, with 23 of its constituents ending in the red.

Its broader peer the 50-share Nifty dropped 263.05 points or 1.14 per cent to close at 22829.15, tanking below the 23000-level for the first time since June 6, 2024.

Rupee falls

At the forex markets, Trump’s tariff threat gave a fresh impetus to the dollar resulting in the rupee closing lower at 86.34 against the previous finish of 86.21. Forex circles added that a weaker yuan also exerted pressure on the rupee.

“We expect the rupee to trade with negative bias on the positive US dollar and weak tone in the domestic markets. Persistent FPI outflows and importer demand for dollars may continue to pressurise the rupee.

“However, weakness in crude oil prices and central bank intervention may support the rupee,” Anuj Choudhary, research analyst at Mirae Asset Sharekhan, said.