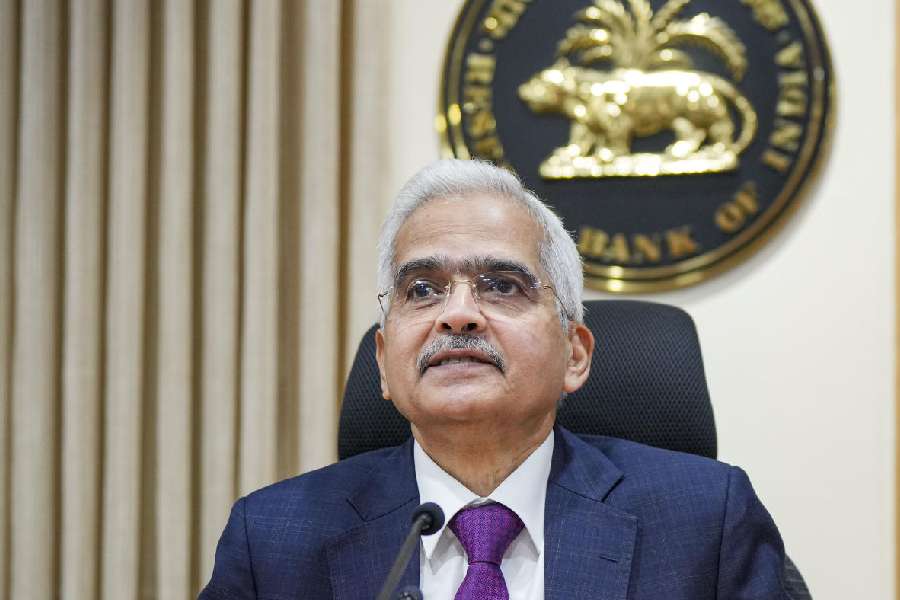

Digitalisation in finance is paving the way for next-generation banking, improving access to financial services at affordable costs. But it also presents challenges related to cybersecurity, data privacy, vendor and third-party risks and customer protection, Reserve Bank of India (RBI) governor Shaktikanta Das has said.

Das made these remarks in the foreword of the central bank’s ‘Report on Currency and Finance (RCF) for the year 2023-24’.

India is leading the global digital revolution, emerging as a frontrunner on the back of its robust digital public infrastructure, rapidly evolving institutional arrangements and a growing tech-savvy population, Das said.

The country ranks first in biometric-based identification (Aadhaar) and real-time payments volume, second in telecom subscribers and third in terms of the start-up ecosystem.

According to the report, while India is at the forefront of the digital revolution, it has embraced not just financial technology (FinTech) by speeding up digital payments but has also celebrated the ‘India Stack’ comprising biometric identification, the Unified Payments Interface (UPI), mobile connectivity, digital lockers and consent-based data sharing.

The report stated that the digital economy currently accounts for a tenth of India’s GDP. Given the growth rates observed over the past decade, it is poised to constitute a fifth of GDP by 2026.

Several enabling forces have come together to energise this revolution. Although internet penetration in India was at 55 per cent in 2023, the internet user base has grown by 199 million in the recent three years.

Further, the country’s cost per gigabyte (GB) of data consumed is the lowest globally at an average of ₹13.32 ($0.16) per GB.

India also has one of the highest mobile data consumption in the world, with an average per-user per-month consumption of 24.1 GB in 2023.

Here Das pointed out that fintechs are collaborating with banks and non-banking financial companies (NBFCs) as lending service providers.