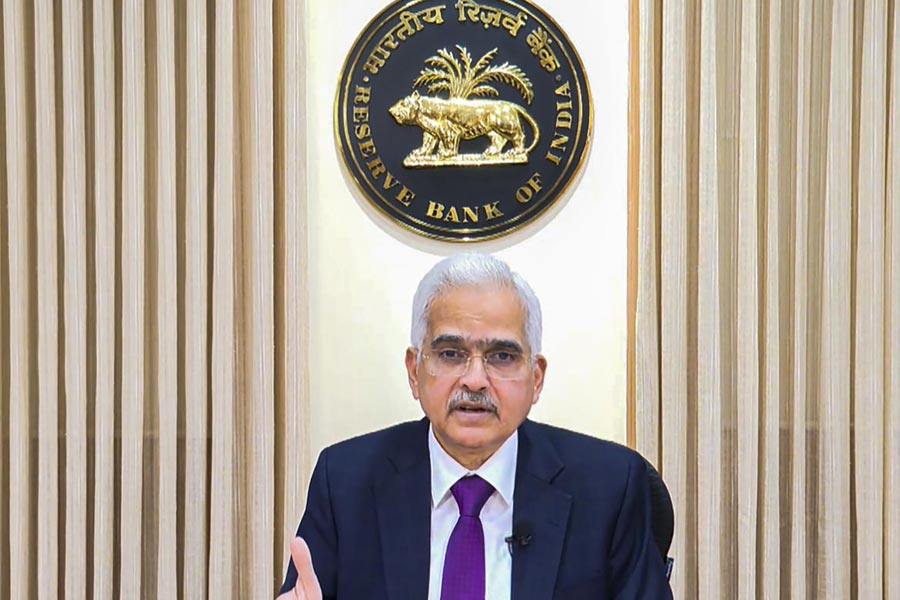

RBI governor Shaktikanta Das has warned divergence in global monetary policies — monetary easing in some economies, tightening in a few and pause in several other economies – can lead to volatility in capital flows and exchange rates, which may disrupt financial stability.

“Monetary policy actions in systemic economies produce large fluctuations in capital flows and exchange rates, which can then feed into domestic liquidity, inflation and eventually affect the real economy,” Das said at a conference organised by the Reserve Bank of India in New Delhi on Monday.

“While monetary policies in the systemic economies are determined by their domestic inflation-growth considerations, they have large spillovers to the emerging and developing economies and even to other advanced economies.’’

Besides the monetary policies, Das pointed to two other risks to financial stability.

Private credit markets have expanded rapidly with limited regulation, he said, adding, they pose significant risks to stability, particularly since they have not been stress-tested in a downturn.

Second, higher interest rates, aimed at curtailing inflationary pressures, have led to increase in debt servicing costs, financial market volatility and risks to asset quality.

Stretched asset valuations in some jurisdictions could trigger contagion across financial markets, creating further instability, he added.

Das said emerging economies are having to strengthen their policy frameworks and buffers to manage this external flux and mitigate its adverse consequences.

The RBI governor also raised concerns over the misuse of AI in the banking space, which he said could lead to more cyber-attacks and data breaches.

“Banks and other financial institutions must put in place adequate risk mitigation measures against all these risks. In the ultimate analysis, banks have to ride on the advantages of AI and Bigtech and not allow the latter to ride on them,” he said.

He also made a case for reducing time and cost of overseas remittances.

“Remittances are the starting point for many emerging and developing economies, including India, to explore cross-border peer-to-peer (P2P) payments. We believe there is immense scope to significantly reduce the cost and time for such remittances.”