If you are an investor interested in closed-end debt funds, chances are that your adviser has recently reached out to you with information to lock in the current market yield of AA- and A-rated instruments trading in the range of 8.9-9.8 per cent and gain from tax-efficient returns as well, courtesy a product rolled out by one of India’s top fund houses.

We bring up this topic to underscore a major contemporary trend in debt investment, marked as it is by a raft of depressing issues, ranging from pedestrian returns delivered by the mainstream funds to the recent default by IL&FS, the infrastructure financing group.

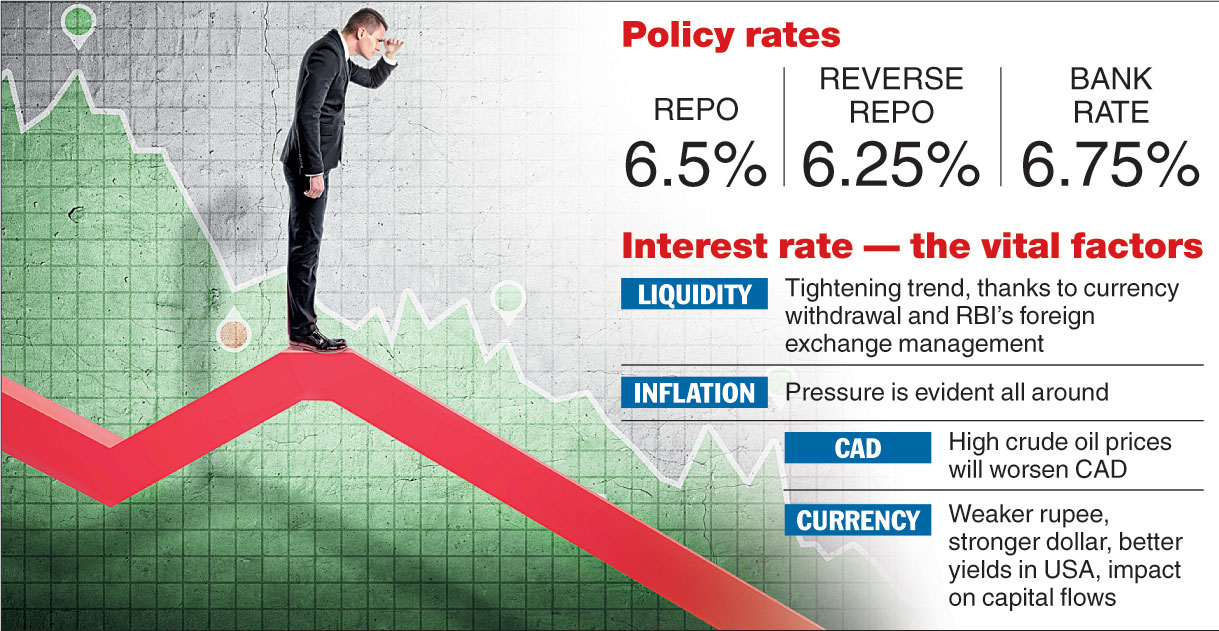

However, topping these are factors that have hit the Indian market quite hard in recent times — a gyrating rupee, inflationary pressure, higher rates in the US and capital outflows.

These inter-linked factors, especially the weak currency, have combined to create considerable pressure on the economy, so much so that the Reserve Bank of India is expected to tweak policy rates again.

The recent rate hikes have already unleashed a ripple effect on the financial system; interest rates on savings and investment products have generally gone up as a result of the banking regulator’s moves.

The fact that various kinds of deposits have started offering higher rates has posed an immediate challenge to certain categories of debt funds, including the closed-end ones. Here, in this article, we will explore the relevant choices available to investors in a scenario of escalating rates.

Fixed returns gain edge

Instruments offering assured returns — fixed deposits offered by various financial services companies, for instance — have lately gained plenty of ground, now that the rates have turned northwards.

Housing finance companies (which already have an advantage over banks when it comes to deposit rates) have witnessed a surge in applications by depositors.

Their experience is shared by various consumer finance companies and assorted loan providers.

For the average investor, the situation at this juncture can be expressed in terms of the following binary:

- Fixed return options have turned more attractive, thanks to better yields. It is not difficult to locate good triple A rated deposit-raising companies with decent track records.

- Actively managed debt funds come with their own set of problems, subject to credit risks and interest rate risks.

In a backdrop characterised by relatively modest returns, it makes sense for investors to stay in short-term products such as liquid funds.

Typical three- or five-year allocation strategies for debt are not quite being recommended seriously these days.

What will investors do?

It seems that the apex bank will step up rates in its next policy, now that there are inflation risks amid decent GDP growth (as in the first quarter) and a weak rupee. Whether this will really have a calming effect on the economy will only be known later.

Higher international crude oil prices and the possibility of a trade war among global economic bigwigs will only hurt our case.

Incidentally, the rupee is currently Asia’s worst-performing currency. At another level, there could well be political uncertainty next year in the context of the forthcoming general election.

Given this backdrop, the following may be suggested:

- Re-balance your debt allocation (but not if your risk appetite specifically disallows this) and opt for a few good fixed-return instruments to the extent possible.

- When it comes to deposits, your choices should be guided by credit ratings, promoters’ credentials and so on.

A rating will help you address a few serious issues: Is the instrument chosen by me investment-worthy? Will the issuer be able to pay interest and repay my principal in a timely manner in line with the mandate?

- When it comes to managed debt, select open-ended funds that essentially provide stability and liquidity. Shorter term funds are being preferred by most sections; however, this is a choice that has to be exercised very carefully.

- Remember your costs. Re-balancing moves, including redemptions and switches, can result in the imposition of loads. There may be taxation issues too. Do check whether your transactions are tax efficient.

The big issue at the moment relates to the kind of returns actively-managed debt can yield. The returns are expected to remain flat and uninspiring for most parts.

Nevertheless, a section of investors will continue to hold and invest in debt funds for various reasons, stability of income and liquidity being the two primary ones.

If you consider the major groups/classifications into which debt funds are now divided, you will have a fair idea of the expected returns. However, investors will do well to allocate cautiously, keeping in view their own risk-return metric.

Broadly speaking, liquid and ultra short-term funds can be used for three months and 3-6 months, respectively. Low duration funds seem ideal for 6-12 months, while short duration funds are good for 1-3 years.

Medium and long duration funds are appropriate for 3-4 years and 4-7 years, respectively.

These are proposed time horizons, and each investor should look at it on the basis of his unique risk profile. To ensure clarity, a professional financial planner needs to be consulted.

The writer is director, Wishlist Capital Advisors