The latest rate cut by the Reserve Bank of India did raise eyebrows — not everybody expected it to occur at this juncture. Ever since it has happened, the market made no bones about how surprised it was. Nevertheless, life has already progressed at a fast clip and here we are, waiting for investment sentiments to improve, looking for probable gains for those who are currently exposed to debt. Yet there are warning signals for all discerning investors, spawned as they have from potential risks stemming from poor credit quality and adverse interest rate movements. Let’s go through a checklist that every participant must keep ready before deciding to allocate.

The central bank has reduced the policy repo rate by 25 basis points to 6.25 per cent with a change in stance to neutral. The altered strategy is said to have its moorings in a key fundamental factor: Low inflation metrics. The CPI (or consumer price index) forecast has been revised downwards to 2.8 per cent in the fourth quarter of 2018-19, and 3.2-3.4 per cent in the first half of 2019-20. However, the market will still need to address the concerns on slowdown in growth and investment.

It is against this backdrop that investors must devise their strategy, calibrating it clearly in favour of short-term debt. Short-term as well as select medium-term products are being prescribed at the moment and there is little chance that the stance will be revised to accommodate long-term options.

Such long-term options are said to be fraught with risks, particularly those arising out of interest rates. After all, unstable yields are bound to ruin the party. The smarter idea also is to generate steady returns within sufficiently short-term periods but without compromising on the credit quality of portfolios.

(Telegraph picture)

Return expectations

Inflation is fairly benign at the moment, and as it so happens, investors do not anticipate a quick reversal on the price front. An influential section believes that inflation, moderated by low food prices, will hover below the 4-per-cent mark during the next 12 months or so.

A persistently low price tendency will ultimately create room for a further rate cut. Here, do remember thatwhile the central bank is bent on handling liquidity concerns, there are no immediate chances of a follow-up rate reduction.

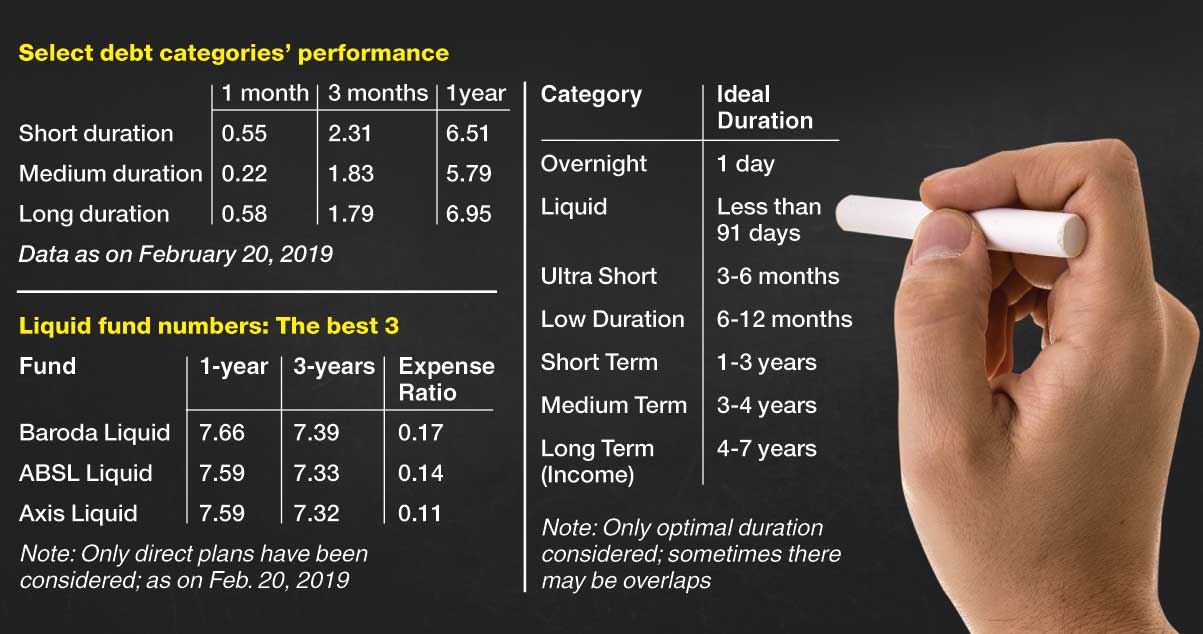

In this context, return expectations from certain categories of debt funds need to be somewhat tempered. Funds that are ideal for shorter durations, say, up to three years, will act as the preferred vehicles for investors’ surpluses. Gains from such debt products are likely to remain predictable. Participants will do good in clearly favouring funds that fit three of the most popular categories — liquid, ultra short and low duration. These should be able to generate 7-8 per cent returns.

So, anything beyond 8-9 per cent can be construed as reasonably superior. A fund manager who can deliver this consistently across market cycles will be billed as asharp shooter.At the same time, one does not foresee great traction on the medium-term front and even less for longer options.

Strategy for investors

Despite all relatively safe and range-bound numbers that have lately surfaced, investors should pursue a cautious tactic in their bid to maximise risk-adjusted growth from debt. They need to stay invested in well-managed short-term funds in line with their risk appetites.

Is there scope for moving away from fixed deposits and instead opt for market-linked performers? Now that rates are under pressure, this question is bound to arise. In this context, here are a few pointers for investors to consider.

- Debt funds can never guarantee performance, while deposits offer pre-announced returns. Deposits, especially corporate deposits, must be chosen with great care. So factors such as the issuers’ business, promoters’ track record and credit rating should be critically reviewed. Just an attractive rate of interest should never be the only consideration.

- If you are indeed choosing debt funds, please select those that can adequately manage interest rate risks. I know that is a big ask and fund managers will face enormous challenges to achieve such objectives.But let this serve as the over-arching principle here.

- At this point, it will be generally safer to avoid closed-end funds. Fixed maturity plans (FMPs), a number of which are expected to be launched in the months ahead, are not the best options for asset allocators right now. Investors should instead adhere to open-ended funds that allow easy exit at the existing net asset value.

- Within the open-ended debt universe, investors must identify portfolios marked by well-rated securities that are in turn considerably liquid. Remember, credit risk is a huge consideration today. There have been several high-profile cases of default in the recent past. There is absolutely no assurance that defaults will not occur in the time to come.

- Within a limited set of good funds, investors should choose the ones that best match their time horizons. Keeping money parked in a liquid fund for, say 12 months, is hardly a smart decision. In other words, there should be a serious effort to pick the best funds for specific timeframes.

The writer is director, Wishlist Capital Advisors