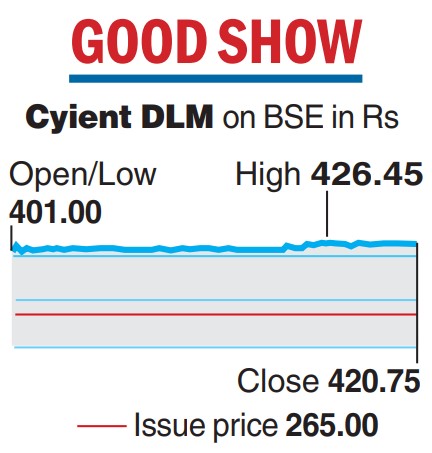

Shares of electronic manufacturing services firm Cyient DLM made a remarkable market debut on Monday and ended with a huge premium of over 59 per cent against the issue price of Rs 265.

The stock made its debut at Rs 401, registering a jump of 51.32 per cent from the issue price on the BSE. During the day, it rallied 60.92 per cent to Rs 426.45. Shares of the company settled at Rs 420.75 apiece, higher by 58.77 per cent.

On the NSE, shares of the company began the day at Rs 403, climbing 52 per cent. It later ended at Rs 421.75 apiece, a gain of 59.15 per cent.

In volume terms, 14.20 lakh shares of the company were traded on the BSE and over 2.10 crore shares on the NSE during the day.

The company commanded a market valuation of Rs 3,336.81 crore.

The initial public offering (IPO) of Cyient DLM got subscribed 67.30 times on the last day of subscription on June 30.

The IPO had a fresh issue aggregating up to Rs 592 crore. There was no offer-for-sale component. The company’s IPO had a price band of Rs 250-265 a share.

Utkarsh SFB to raise Rs 500cr

Calcutta: Utkarsh Small Finance Bank is looking to raise Rs 500 crore through the fresh issue of shares from its public offer which opens on July 12 and closes on July 14.

The bank said it would need to raise equity capital to support growth and maintain capital adequacy above the regulatory threshold of 15 per cent.

A price band of Rs 23-25 has been set for the public offer for shares of face value of Rs 10 each. Of the net issue, 75 per cent will be allotted on a proportional basis to qualified institutional buyers.

The bank’s capital adequacy was 20.34 per cent as of March 31.

The bank’s officials on Monday said the fundraise would increase the capital adequacy by an additional 3-4 per cent. While the bank would be investing to grow its business, it plans to keep the capital adequacy at above 20 per cent.

“Our bank proposes to utilize the net proceeds from the issue towards augmenting its Tier – 1 capital base to meet its future capital requirements. Further, the proceeds from the issue will also be used towards meeting the expenses in relation to the issue,” the bank has said in its prospectus.

The bank is promoted by Utkarsh CoreInvest Limited.

A STAFF REPORTER