Bad loan disclosure

In a separate notification, the central bank tweaked rules on disclosures banks make with regard to bad loan divergence that occurs due to a difference in bad loans assessed by RBI inspection compared with what is reported by a bank.

The regulator said it was observed that some lenders on account of low, or negative, net profit after tax, are required to disclose divergences even where the additional provisioning assessed by the RBI is small.

This is contrary to the regulatory intent that only material divergences should be disclosed.

In a separate notification, the central bank tweaked rules on disclosures banks make with regard to bad loan divergence that occurs due to a difference in bad loans assessed by RBI inspection compared with what is reported by a bank.

The regulator said it was observed that some lenders on account of low, or negative, net profit after tax, are required to disclose divergences even where the additional provisioning assessed by the RBI is small.

This is contrary to the regulatory intent that only material divergences should be disclosed.

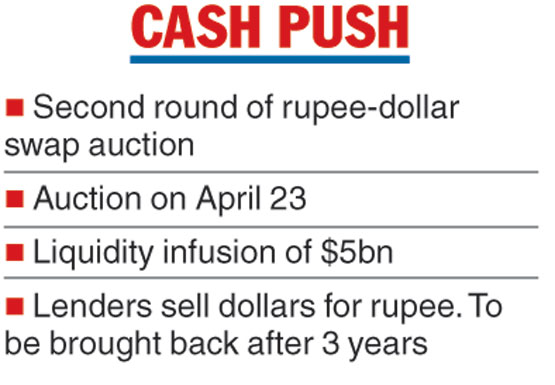

The Reserve Bank of India (RBI) on Monday announced a second rupee-dollar swap auction to infuse rupee liquidity into the system. The first swap auction was held just a week ago, with the RBI injecting Rs 34,500 crore into the system.

The central bank on Monday announced it would inject long-term liquidity worth $5 billion through dollar-rupee buy-sell swap for a tenure of three years on April 23.

“In order to meet the durable liquidity needs of the system, the RBI has decided to inject rupee liquidity for a longer duration through long-term foreign exchange buy/sell swap in terms of its extant liquidity management framework,” the central bank said in a statement.

The new mechanism, which will add to the liquidity toolkit of the central bank, will see banks selling dollars to the RBI in exchange for rupees.

The dollars sold by the lenders will be bought back at the end of the swap period which will be three years.

In the first auction, the apex bank received 240 bids worth $16.31 billion against the target of $5 billion. The RBI accepted 89 offers of $ 5.02 billion and fixed a cut-off premium of Rs 7.76. This is the premium banks will have to pay over the current exchange rate after a period of three years.

The RBI said the market participants would be required to place their bids in terms of the premium they would pay to the RBI for the tenor of the swap.

The minimum size of each bid should be $10 million and in multiples of $1 million thereafter.

The Telegraph