Members of the Monetary Policy Committee (MPC) have expressed concern that the surge in Covid-19 cases could trip the nascent economic recovery, according to the minutes of the meeting held earlier this month. The panel also called for speeding up the vaccination drive even as it reiterated that the accommodative policy should continue till economic recovery is assured.

The six-member MPC had met from April 5-7 where they kept the policy repo rate unchanged at 4 per cent, while the growth forecast was retained at 10.5 per cent for this fiscal.

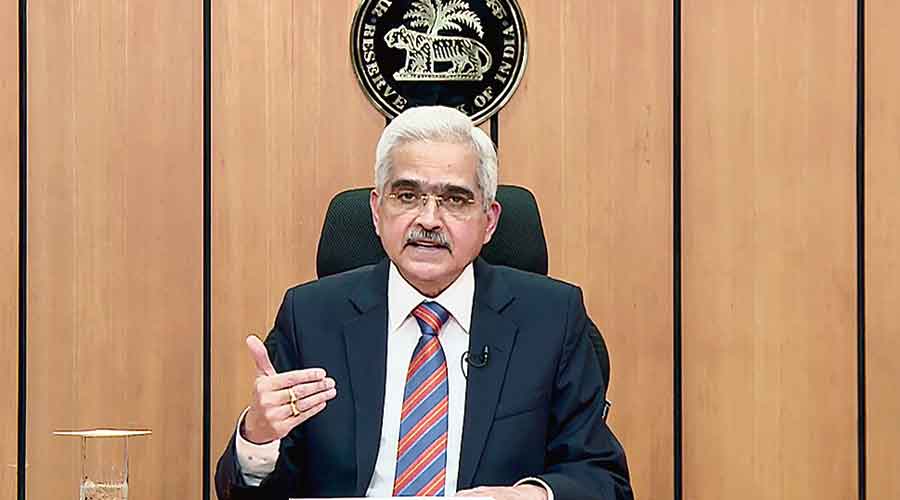

Minutes of the meeting released on Thursday by the RBI showed governor Shaktikanta Das pointing out that the rapidly rising cases is the single biggest challenge to the ongoing recovery in the Indian economy. He said that global growth is gradually recovering, even though it remains uneven across countries, reflecting the substantial differences in the infection trajectory, the speed of vaccination drives and the size of fiscal stimulus.

“The renewed jump in Covid-19 infections and the associated localised lockdowns add uncertainty to the growth outlook. In such an environment, monetary policy should remain accommodative to support the recovery,” he added.

S&P caution

S&P Global Ratings on Thursday said the Indian economy is projected to grow at 11 per cent in the current fiscal, but flagged the “substantial” impact of broader lockdowns on the economy.

Meanwhile, Fitch Ratings on Thursday affirmed ‘BBB-’ sovereign rating for India, saying a recent surge in coronavirus cases may delay GDP recovery, but it won’t derail the economy. It maintained a negative outlook for the rating reflecting “lingering uncertainty around the debt trajectory”.