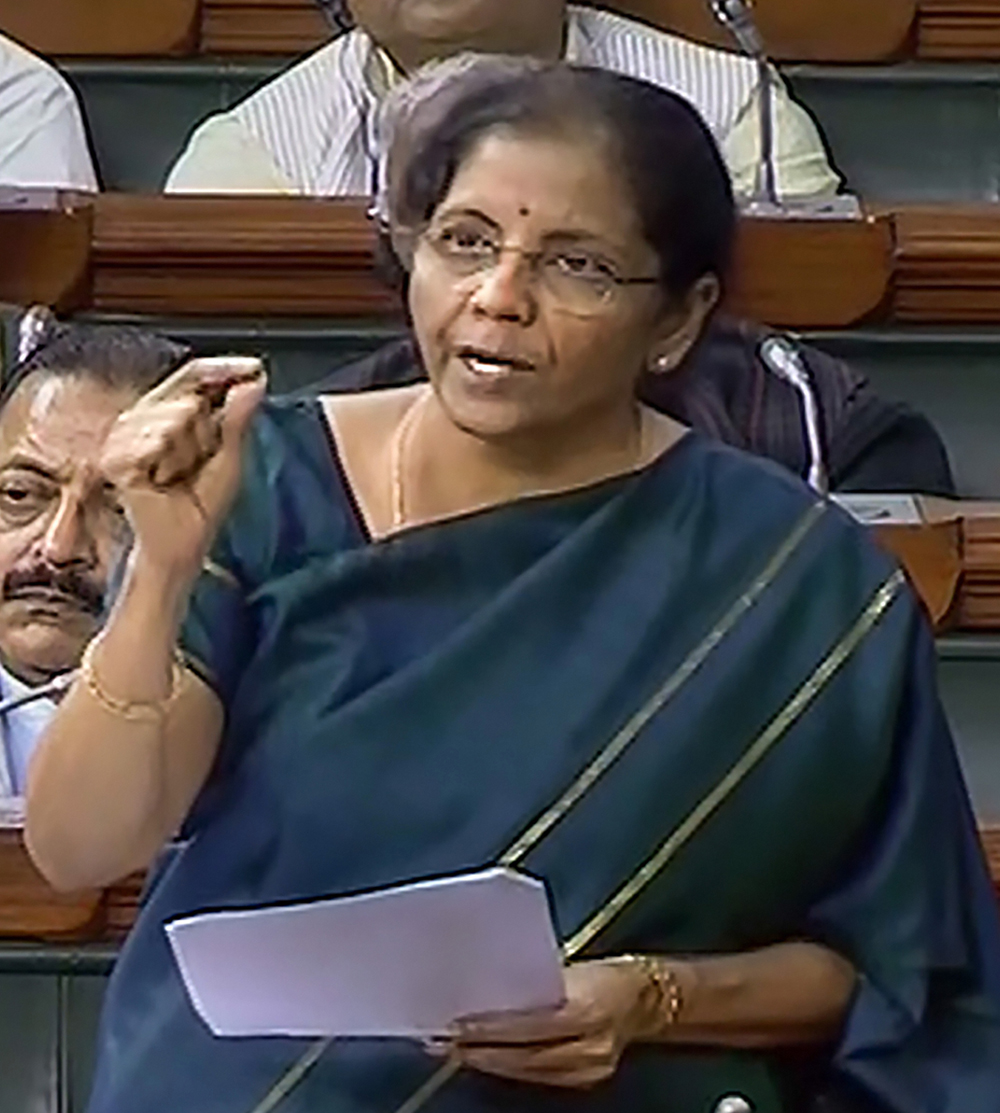

Some of the relief measures to deal with the economic impact of coronavirus could be announced by finance minister Nirmala Sitharaman during her reply to the debate on the Finance Bill next week.

The Finance Bill is slated to be taken up by the Lok Sabha on Monday.

Sitharaman held a meeting with senior finance ministry officials on Saturday and is believed to have discussed sector specific measures to be announced during the reply to the bill later next week.

Industry body CII has pressed for a fiscal stimulus of Rs 2 lakh crore besides a slew of tax cuts and reduction in interest rates. Ficci said a combination of monetary, fiscal and financial market measures were needed now.

Sources said some of the proposals under consideration include changing the definition of non-performing assets (NPAs).

As of now, non-payment of principal or interest for 90 days or three consecutive EMIs (equated monthly instalments) makes any loan account as NPA. Once the account become an NPA, it is difficult for the borrower to get a further loan.

The industry has demanded that the norm of 90 days should be changed to 180 days or six EMIs. There should also be a provision for a further loan for working capital requirement.

According to sources, the finance ministry and the RBI are in active consultation to find ways so that the banking sector is not affected.