Money, like nature, abhors vacuum. In a backdrop marked by the worldwide spread of a lethal virus and the consequent decline in all sorts of economic indicators, equity has evidently blunted its edge. Debt has crawled into its place, drawing considerable attention from investors, big and small. It is set to remain the cynosure of all eyes, at least temporarily, or till equity and other asset classes regain some of the lustre they have lost. And that is not going to happen in a hurry.

Substantial action seems to be unfolding on the debt front, and investment circles must familiarise themselves with the latest developments. They also need to modify their allocation strategies to meet the new realities. But first let us refer quickly to some of the most recent happenings.

For starters, the banking regulator has reduced its repo rate to 4 per cent from 4.40 per cent, a move that will ease some of the pressure that has built up in the banking system. It has further announced a series of measures, paving the way for higher lending by banks to corporates. The average consumer, too, is waiting for the benefit of rate adjustments to be transmitted to loan takers. All this will augur well for the market as a whole, at least in theory.

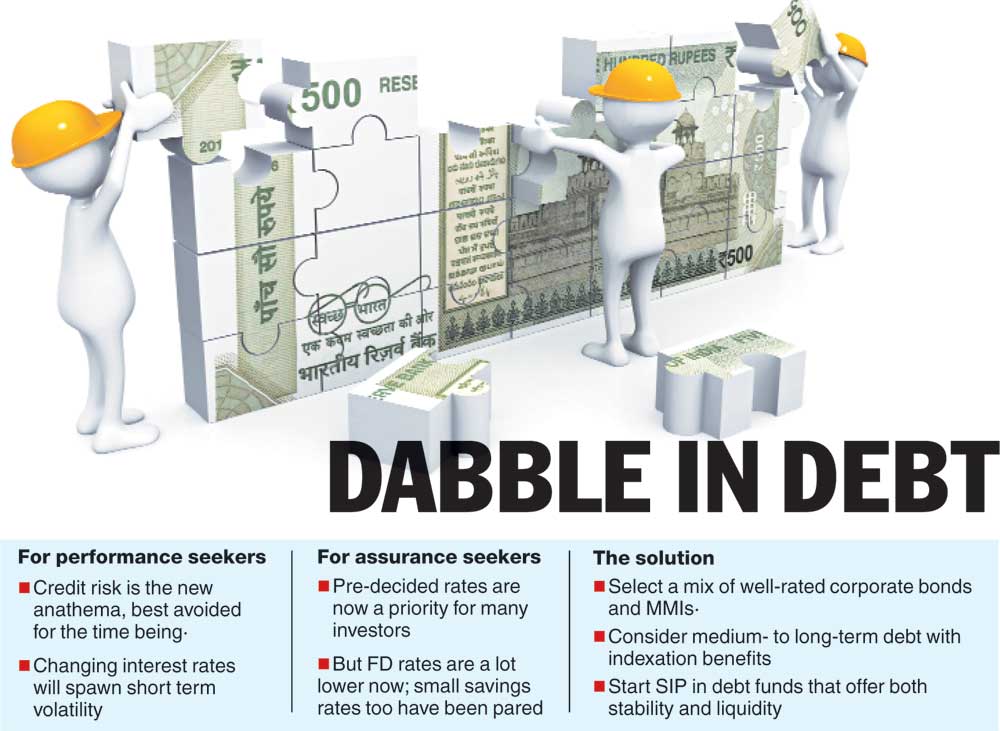

In practice, however, a number of mammoth worries have emerged. Some of these stem largely from probable “credit events”. There are concerns that corporates will be unable to meet their commitments in these recessionary conditions. Markets will shrink, work will stop, logistics will contract and input costs will rise. In short, there will be losses — and, as a consequence, companies will be unable to meet their debt obligations. Defaults, therefore, will be a standard feature in the days ahead.

For debt, a checklist

Debt enthusiasts must never forget two vital considerations — stability and liquidity. As for the first, elements like consistency of portfolio and preservation of capital are of prime significance. Keeping that in mind, there is a clear case for tried and tested options. Together, they will keep the average debt allocation as safe as possible.

As for the second factor, debt investments should be sufficiently liquid. If you are invested in managed debt (say, in an actively managed medium-term debt fund), you must ensure that the individual holdings are liquid enough. The fund manager concerned should be able to sell them to meet any probable redemption requests.

Nothing, of course, is risk free. Yet an investor who needlessly chases returns and disregards danger, will simply imperil his holdings. That has been happening in debt circles for quite some time, and right now an influential section of the market is suffering because of the huge risk it has taken all this while.

For them, the following can be prescribed:

⦾ Set up an emergency corpus after keeping aside money to meet current household expenses, covering three months or so — use a mix of liquid funds to do this in a cost-efficient manner.

⦾ Spread the rest of your investible surplus over two primary groups of debt funds, keeping in view the medium and long-term needs. Understand the nuances of each group. This will enable you to meet the most critical financial goals.

⦾ As for fresh allocations, begin systematic investment plans in funds of your choice in line with your ideal asset allocation.

⦾ Take advantage of indexing by investing in funds for the long term. Opt for open-end products at all times; this will ensure flexibility.

⦾ When you assess a particular option, remember to weigh all the relevant factors. The latter will include weighted average maturity, credit quality and expense ratio.

Work out a debt strategy

Given the current goings-on, what should investors do to cope with the situation? Considering present-day market volatility and the kind of spreads that corporate bonds offer over the repo, a smart investor should largely indulge in two prime choices — well-rated bonds and money market instruments. The assured returns seeker is not being considered here.

An efficient strategy would entail a portfolio with graded exposure to such bonds and MMIs. The bet would then be on low to moderate duration. The combination of the two is expected to deliver superior risk-adjusted returns over a decent stretch of time.

If you wish to really root for safety, stick primarily to low-risk debt funds in keeping with your asset allocation plan. You may, for example, indulge in only liquid and MMIs. You will sleep well, given the fact that these funds invest merely in treasury bills, commercial paper, certificate of deposit. Nothing that will shatter the earth, and in the process, your money remains safer.

If you are willing to take more risk, go in for elevated categories of debt funds, but only selectively. For the conservative player, low duration funds and ultra short-term funds are worth considering. The more aggressive participant can opt for income funds for the short and medium terms.

If you are not too keen on performance-driven returns, you can work out a combination of fixed deposits. While bank deposits can form the core, deposits offered by select financial services companies can serve as smart additions. Many of these bring superior rates to the table. Deposits mobilised by housing finance companies, for instance, are somewhat more lucrative than the choices provided by traditional banks. Of course, only the best rated companies must be chosen.

The writer is director, Wishlist Capital Advisors