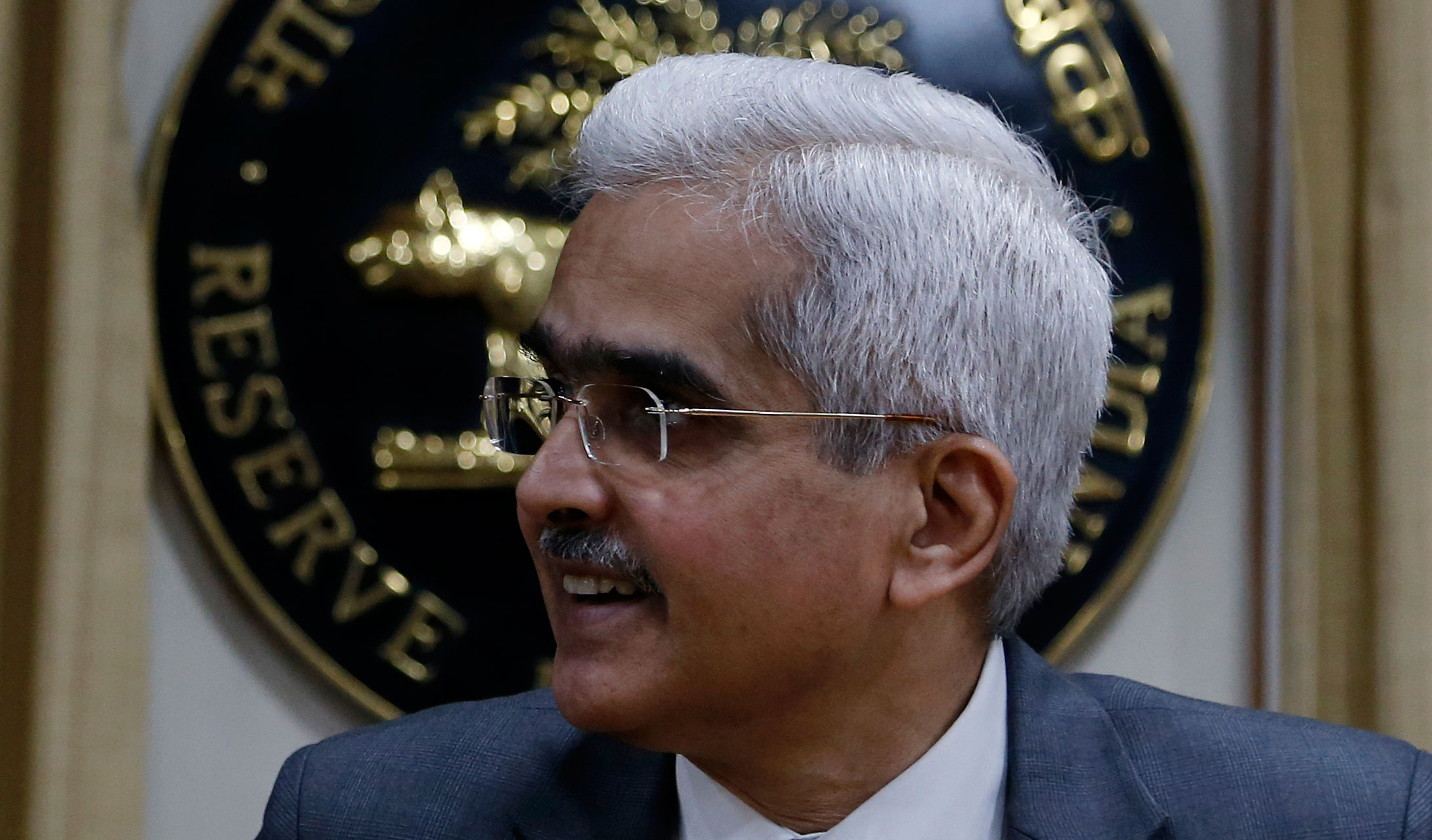

RBI governor Shaktikanta Das has put pressure on the Centre for a stimulus package after unveiling its own monetary measures in the past fortnight.

In an interview to news agency Cogencis, Das said the fiscal measures were absolutely essential to revive a faltering economy and combat the economic impact of Covid-19.

He said the government was working on a fiscal package of measures and they must have sunset provisions. The fiscal steps must be well targeted for the best outcomes and should be prioritised.

Das said the fiscal deficit will cross 3.5 per cent of GDP this year, and direct tax, GST collections will be badly affected in the first quarter because of the lockdown.

The Centre should not, however, go overboard on the deficit and take a “judicious and balanced” call.

All weapons in the monetary policy arsenal of the RBI are on the table but the central bank hasn’t taken a decision yet on deficit monetisation, the RBI governor said. The RBI has not taken any view on floating Covid bonds, either.

“The 3.5 per cent fiscal deficit target for this year will be very challenging to meet. As regards, how much it will exceed and how much the government will spend, that will depend on the view taken by the government,” he said.

While both conventional and unconventional measures are on the table, the central bank will take a judicious and balanced judgement call, depending on how the evolving situation plays out, he said.

Moreover, the RBI will consider the operational realities and the need to preserve the strength of its balance sheet, and also the goal of macroeconomic stability which is its primary mandate.

Even as the Centre dithered over announcing a stimulus package, the RBI on Monday announced a Rs 50,000 crore liquidity facility for mutual funds, one among the numerous measures it has taken since the lockdown.

On the recent targeted long term repo operations meant for NBFCs and MFIs (TLTRO 2.0), which flopped, Das said the RBI had a sense that the response may not be as strong as the first version of TLTRO inspite of additional incentives.

The auction results conveyed a crucial message that banks were not willing to take on credit risk on their balance sheets beyond a point.

He said the RBI was reviewing the whole situation and based on that, it would decide on its approach.

Forecast lowered

Domestic rating agency Crisil on Monday nearly halved its GDP forecast for India to 1.8 per cent for 2020-21, while projecting total losses of Rs 10 lakh crore, or Rs 7,000 per person, due to “disastrous” lockdowns to control the Covid-19 pandemic.

The agency, which blamed the government’s response to the crisis and asked it to drastically raise the support, had a GDP growth estimate of 6 per cent for 2020-21, which was last revised to 3.5 per cent in late March.

Another rating agency, India Ratings and Research (Ind-Ra), has also revised the economic growth forecast for the country further down to 1.9 per cent, the lowest in the last 29 years.

The nation has been put under a 40-day lockdown in two phases till May 3.