The benchmark Sensex on Monday sank nearly 807 points, the second biggest single-day fall this year, tracking selloffs in the global markets as coronavirus cases rose exponentially outside China.

The virus dented the rupee, which fell 34 paise against the dollar, while gold prices rose even as world oil prices tumbled as concerns multiplied over the impact of the virus.

Starting off on a weaker note, the Sensex plunged to a day’s low of 40306.36 after being caught in panic selling as investors fretted over the large number of new virus cases in South Korea, Italy and Iran.

The 30-share index finally settled at 40363.23, dropping 806.89 points, or 1.96 per cent — the second biggest one-day fall in 2020. The Sensex had plunged over 987 points on February 1 this year — the day the Union budget was presented. The broader NSE Nifty sank 251.45 points, or 2.08 per cent, to 11829.40.

All Sensex components ended in the red, with Tata Steel cracking 6.39 per cent, followed by ONGC, Maruti, HDFC, Titan and ICICI Bank.

Sectorally, the BSE metal index tumbled nearly 6 per cent, auto 3.39 per cent and telecom 3.33 per cent. All sectoral indices closed in the red.

Global alarm

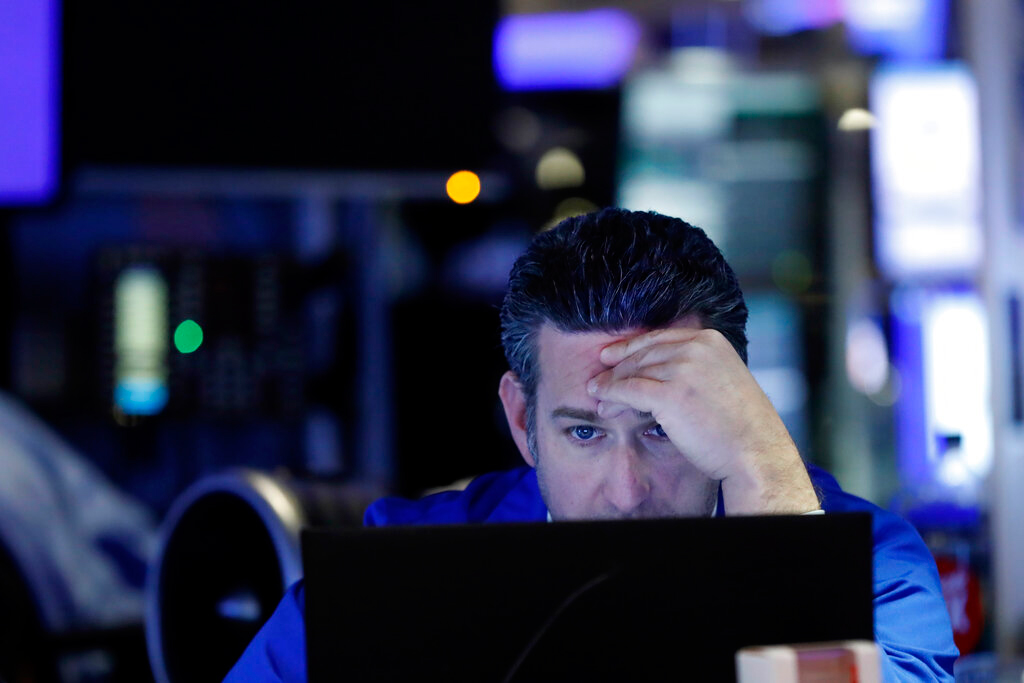

Globally, equities bore the brunt of a worsening trading sentiment as investors scurried to safer assets after a surge in cases outside China stoked fears of a bigger impact to global growth.

The Dow Jones Industrials fell more than 800 points within minutes of the market opening on Monday.

The benchmark S&P 500 fell below its 50-day moving average, while the blue-chip Dow slipped below its 100-day moving average, all closely watched indicators of momentum.

Seoul stocks ended deeply in the red after South Korea reported 161 more cases on Monday, taking the overall virus cases to 763 and making it the world’s largest total outside China.

Bourses in Shanghai, Tokyo and Hong Kong also closed with significant losses.

Stock exchanges in Europe sank in opening trade with Milan’s FTSE MIB plunging over 4 per cent after Italy reported its fourth death.

On the domestic front, investors were eyeing US President Donald Trump’s two-day visit to India for further cues on trade front. He reached Ahmedabad earlier in the day.

“Demand for safe-haven assets spiked as fresh coronavirus cases in South Korea and Italy indicated that business impact could be higher than thought earlier. The Trump-Modi meet is not providing clues to the market regarding trade deal but market is hoping for some hint in the future,” said Vinod Nair, head of research at Geojit Financial Services.

Rupee sinks

The rupee on Monday fell 34 paise to close at more than three-month low of 71.98 against the dollar, tracking heavy selling in domestic equities and the strengthening of the American currency in the overseas market.

World oil prices sank more than four per cent on Monday. Benchmark contracts Brent North Sea and New York’s West Texas Intermediate both slumped 4.1 and 4 per cent respectively, compared with their levels late Friday.

Gold shines

Gold prices on Monday soared Rs 953 to Rs 44,472 per 10 gram in the national capital on a weak rupee and the rise in global prices. Gold prices had closed at Rs 43,519 per 10 gram in the previous trading session.