Two proposals

Anuj Puri, chairman of Anarock Property Consultants, last week said the GST Council may be considering two proposals.

“The first is to maintain a fixed 12 per cent GST rate, including full input tax credit to builders. This will eventually make the effective GST rate 8 per cent once the input cost of land is accounted for and reduced. It would, in fact, bring it on a par with the prevailing affordable housing tax rate.

“The second proposal stipulates a flat 5 per cent GST to be applicable to under-construction properties without including the input tax credit benefit, provided the builder purchases at least 80 per cent of the raw materials from GST-registered suppliers,” Puri said in the note.

In the past, the government had a dual tax rate for restaurants, 12 per cent for non-AC and 18 per cent for AC eateries with input tax credit. It then imposed a flat 5 per cent tax on all restaurants without input tax credit.

In December, the Union finance ministry had issued a statement stressing that prices should not go up for under-construction property after factoring in the input tax credit and warned developers to pass on benefits to buyers.

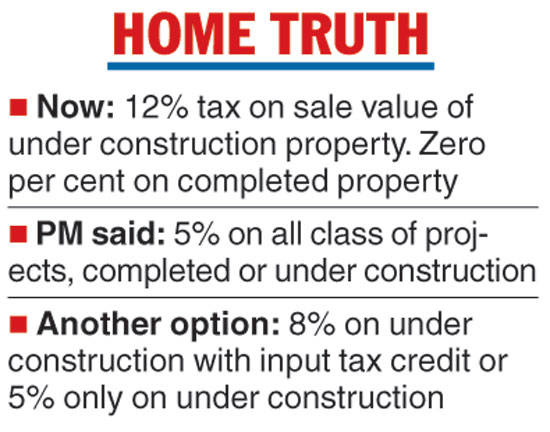

Prime Minister Narendra Modi on Tuesday hinted at the introduction of a GST on completed residential property in a bid to simplify the tax structure for the real estate sector.

In an interview to ANI, Modi said his government wanted to impose a 5 per cent GST on all classes of residential properties, completed or under construction.

While this may benefit the buyers of under-construction properties where they now pay 12 per cent GST, the move will hurt those who are looking to buy projects that have received a completion certificate. As of now, no GST is levied on completed projects.

“There is this GST on under-construction property...what we have done for restaurants, we will do 5 per cent for all..

“We wanted to go to that direction. But there has been reservation from some people... Now this has gone to a committee. We will try to hasten this, (once) the committee gives its report,” Modi said.

He said the move, along with raising the threshold to Rs 75 lakh from Rs 20 lakh for zero tax, would be in line with efforts to simplify the GST.

Differential tax treatment between under-construction and completed projects has been blamed for the slowdown in the real estate sector as buyers were deferring their purchase till a completion certificate was obtained in a particular project to save on the GST. This put additional financial strain on the builders to finance the project as they were not getting enough funds from booking.

Developers welcomed the suggestion to bring down the tax rate to 5 per cent but wondered if the levy of tax on completed projects would be legally possible.

“A completed project is neither a good nor is it a service. It is a property on which stamp duty is paid. During the under-construction phase, the developer provides a service to the buyer by building the project and hence the GST is imposed,” Sushil Mohta, past president of Credai Bengal and owner of Merlin Projects, said.

On December 22, the GST Council sent the issue of taxation of residential property to the Law Committee and Fitment Committee. It is likely to take a view on the subject in the January meeting.

The Telegraph