The Competition Commission of India has given conditional approval to the proposed merger between Zee Entertainment Enterprises Ltd (ZEEL) and Sony.

The watchdog on Tuesday said in a tweet that it has cleared the deal with certain modifications. CCI did not elaborate on the modifications sought.

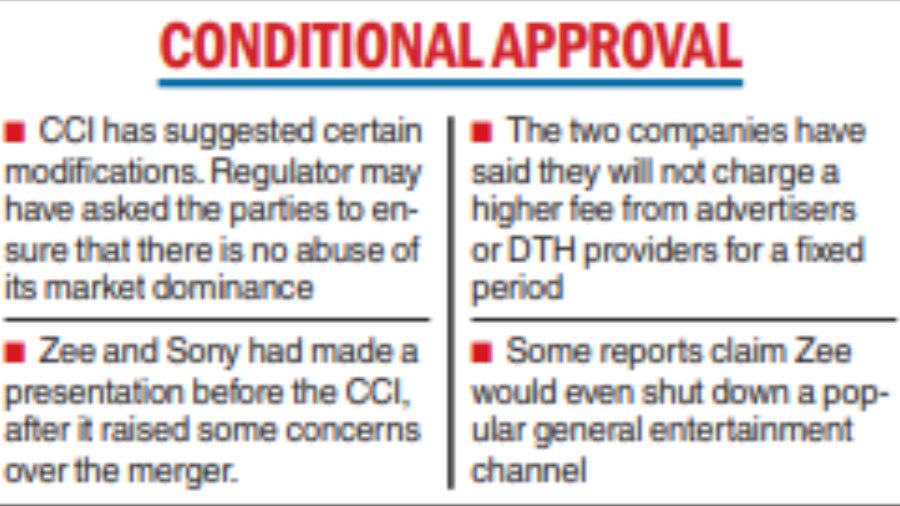

However, it is understood that the regulator has asked the parties to ensure that there is no abuse of its market dominance.

Last week, the two parties made a presentation before the CCI, after it raised some concerns over the merger.

During the meeting, the two companies said they will not abuse their market dominance and not charge a higher fee from advertisers or DTH providers for a fixed period.

Some reports have also claimed that Zee would even shut down a popular general entertainment channel. The identity of the channel was not disclosed.

In August, the CCI had communicated to the companies through a notice that their “humongous market position’’ would allow them to enjoy “unparalleled bargaining power”.

The CCI was reportedly concerned about the impact the merger would have in terms of advertising and channel pricing, particularly in the Hindi language segment.

The CCI said it has approved the “amalgamation of ZEEL and Bangla Entertainment Private Limited (BEPL) with Culver Max Entertainment Private Limited (CME) earlier known as Sony Pictures Networks India Pvt Ltd (SPNI), with certain modifications”. It is learnt that the approval was given after the regulator accepted the voluntary remedies proposed by the parties.

ZEEL, in September 2021, said it has entered into a non-binding term sheet with SPNI an indirect subsidiary of Sony Pictures Entertainment Inc to bring together their linear networks, digital assets, production operations and programme libraries.

Zee had added that the combined entity will own over 70 TV channels, two video streaming services (ZEE5 and Sony LIV) and two film studios (Zee Studios and Sony Pictures Films India), making it the largest entertainment network in India.

“We will now await remaining regulatory approvals to finally launch the newly merged company."

“The merged company will create extraordinary value for Indian consumers and eventually lead the consumer transition from traditional pay TV into the digital future,” a statement from Sony said.

Shares of Zee on Tuesday ended 6.11 per cent, or Rs 15.40, higher at Rs 267.50 on the BSE.

Analysts at Motilal Oswal said in a February report that the proposed merger with Sony has the potential to transform Zee into a media powerhouse even as the deal would enable a strong dominance in the broadcasting space and the capability to be a force in the digital media sector

“The combined entity could leverage the large-scale opportunity in the digital entertainment space.

“Moreover, the company’s deep understanding of the Indian entertainment market and ability to produce a significant quantum of content every week should allow it to have a strong play.”