Coal India has posted a 50 per cent rise in net profit in the October-December quarter of 2018-19. Better realisations from the sale of coal both through auction and fuel supply agreements have propelled the earnings of the public sector miner.

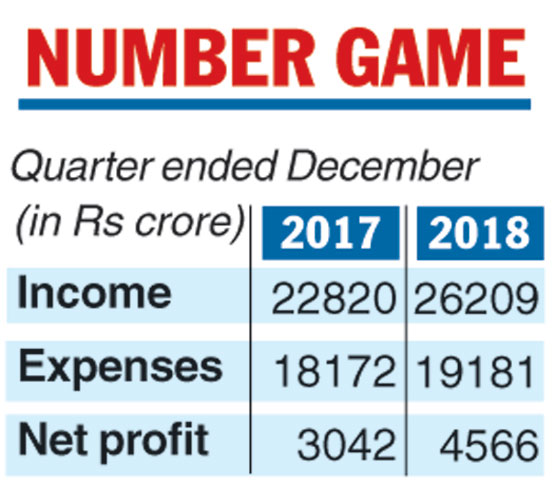

The consolidated net profit of the public sector miner for the quarter was Rs 4,566.81 crore against Rs 3,042.68 crore in the corresponding quarter previous year.

Coal India shares jumped 1.92 per cent to Rs 222.95 on the Bombay Stock Exchange in expectation of better results, which were announced in the evening with analysts predicting bottomline growth.

Total income during the quarter was Rs 26,209.13 crore against Rs 22,820.88 crore in the corresponding previous period. Coal India produced 155.97 million tonnes (mt) and recorded an offtake of 153.83 million tonnes during the quarter. In the corresponding quarter of the previous year, the miner had produced 152.04 million tonnes and the offtake was 152.43 mt.

The average realisation from the sale of coal through fuel supply agreements during the quarter was Rs 1,334 per tonne and the e-auction route, Rs 2,847 per tonne.

The Telegraph

In the corresponding year-ago period, the supply deals fetched Rs 1,182 per tonne and e-auction, Rs 1,998 per tonne.

Total expenses saw an increase to Rs 19,181.06 crore against Rs 18172.78 crore.

Total income of Coal India in the first nine months of 2018-19 was Rs 75,054.78 crore against Rs 63,065.32 crore. Net profit during the period was Rs 11,436.19 crore against

Rs 5,764.62 crore in the same period of the previous financial year.

The company said that during the quarter the government divested 3.19 per cent through Bharat 22 ETF, 2.21 per cent in CPSE ETF and 0.01 per cent through an offer for sale — after which the government holds 72.91 per cent in the PSU.

Moreover, the board in its meeting on February 4, 2019 had approved a buyback of 4,46,80,850 equity shares at a price of Rs 235 per share for an aggregate consideration not exceeding Rs 1,050 crore.