The board of directors of Coal India is set to meet on Monday to consider and approve a share buyback.

“A board meeting of the company is scheduled on Monday, February 4, 2019 interalia to consider and approve buyback of the fully paid up equity shares of the company having a face value of Rs 10 each,” Coal India said in a filing to the BSE on Wednesday.

Managements usually buy back shares when they perceive the price to be undervalued, prompting the company to dip into its reserves and buy the shares that improves the prices. The buyback route has been popular with private companies looking to improve their stock’s performance on the bourses. Now, the central government is exploring this route to unlock value.

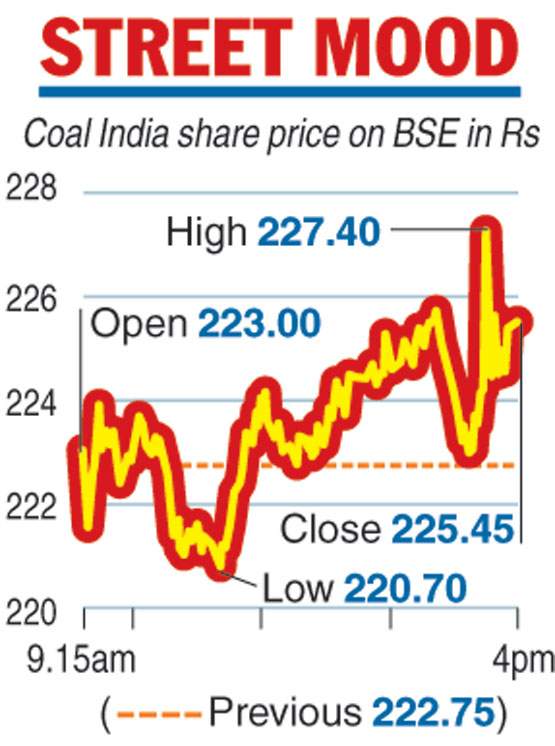

Shares of Coal India closed 1.21 per cent up at Rs 225.45 on the BSE on Wednesday. The scrip, which was at a peak of Rs 314.2 on February 26, 2018, has seen a decline on bourses since November.

Once the buyback is approved and executed, it would be the second time the Centre, which holds a 72.91 per cent stake in the company, will tap the public sector miner in the current financial year to meet its divestment proceeds.

Earlier, the Centre had raised Rs 5,218.30 crore by selling 3 per cent of its shares in the miner through the offer-for-sale route. The Centre’s divestment target is Rs 80,000 crore this fiscal, of which it has raised Rs 35,532.66 crore through a combination of strategic divestment, public offer, buybacks and the ETF route in the ongoing financial year.

Action replay

The buyback will be the second for Coal India. In 2016-17, there was a buyback of 10.89 crore shares, and data show the government had raised Rs 2,638.24 crore from the process.

Coal India, on Tuesday, had informed the bourses that it would raise about Rs 1,065 crore by selling shares to its subsidiaries – Mahanadi Coalfields, South Eastern Coalfields and Northern Coalfields. The three arms, in separate board meetings, decided to buy back a portion of their shares held by Coal India.

Additionally, Coal India pays a hefty dividend to the Centre every year.

Last fiscal, the miner had paid a dividend of Rs 10,242.24 crore of which the share of the government was Rs 8,044.86 crore.

Between April and December 2018, Coal India had produced 412.45 million tonnes, posting a growth of 7.4 per cent over the previous year. The offtake of the miner was up 5.5 per cent to 444.59mt against 421.43mt in the corresponding year-ago period.

The Telegraph