The government on Wednesday said that all urban co-operative banks and multi-state cooperative banks will come under the supervision of the Reserve Bank of India, a development aimed at providing comfort to depositors and prevent the repeat of PMC Bank-like scams.

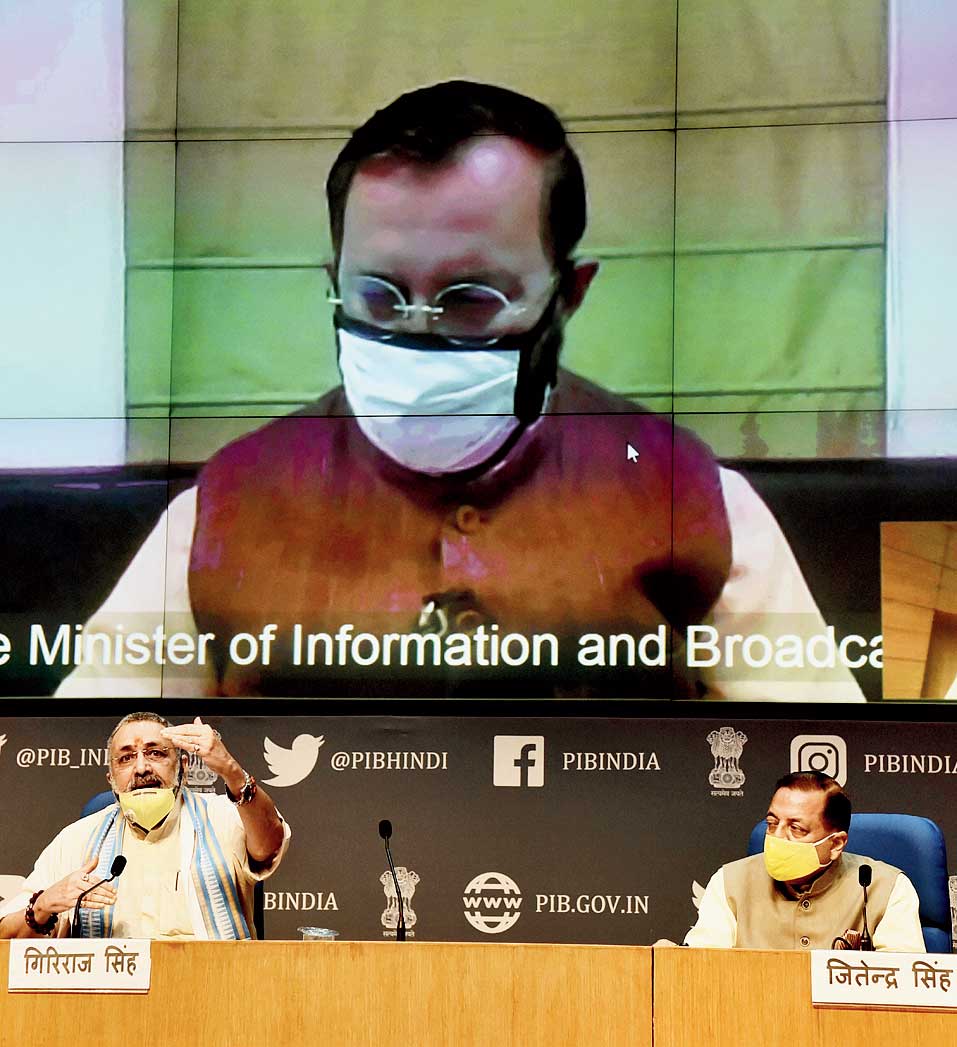

The President of India will promulgate an ordinance to this effect, information and broadcasting minister Prakash Javadekar told reporters after the meeting of the cabinet.

The minister said 1,540 urban co-operative banks and multi-state cooperative banks will be brought under the RBI supervisory process as is applicable in case of scheduled commercial banks. “...depositors (of cooperative banks) will get protection and benefit from this decision,” Javadekar said.

There are 1,482 urban cooperative banks and 58 multi-state cooperative banks having about 8.6 crore depositors with a total savings deposit of about Rs 4.85 lakh crore.

The decision assumes significance in the wake of a scam in Punjab and Maharashtra Cooperative (PMC) Bank and some other cooperative banks, affecting lakhs of customers who are facing difficulty in withdrawing their money because of the restrictions imposed by the RBI.

The RBI had placed regulatory curbs on the PMC Bank on September 23, 2019, after finding out certain financial irregularities and misreporting of loans given to real estate developer HDIL.

Earlier this month, the RBI had put restrictions on withdrawals from People’s Co-operative Bank, Kanpur.

Finance minister Nirmala Sitharaman had introduced The Banking Regulation (Amendment) Bill, 2020 in the Lok Sabha on March 3, 2020, which is pending approval. The proposed law sought to enforce banking regulation guidelines of the RBI on cooperative banks.

In her February 1 budget speech, Sitharaman had proposed amendments to the Banking Regulation Act with an aim to increasing professionalism and improving governance among the cooperative banks.

The cabinet also approved 2 per cent interest subvention on loans up to Rs 50,000.