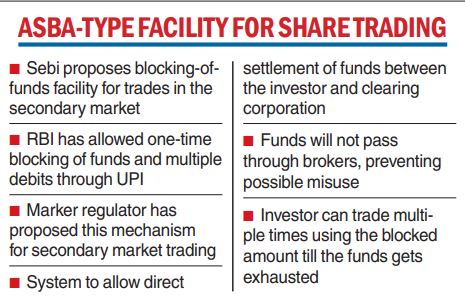

The Securities and Exchange Board of India (Sebi) has proposed the introduction of a blocking-of-funds facility for trading in secondary markets — to protect investors’ money from possible misuse and default by stockbrokers.

The changes planned by the market regulator are similar to Application Supported by Blocked Amount (ASBA), which is available in the primary market. Under ASBA, the funds of an investor gets deducted only when allotment happens in an initial public offering (IPO).

In a consultation paper, released Tuesday, the market regulator proposed a model where funds will remain in the bank account of the client thereby eliminating the need to transfer funds to the stockbroker.

The funds will be blocked in favour of the clearing corporation (CC) till the expiry date of the block mandate or till the block is released by CC. The clearing corp can debit funds from the client account, limited to the amount specified in the block.

Sebi’s move follows one by the Reserve Bank of India to allow a one-time blocking of funds in bank accounts and multiple debits through the unified payments interface (UPI) real-time payments system.

The market regulator said the UPI service can be integrated with the secondary markets to provide a block mechanism where the clients will be able to block funds in their bank account for trading in secondary market, instead of transferring them upfront to the trading member, thereby providing enhanced protection of cash collateral.

Under the proposed system, investors can also block lump sum amount. Their block can be debited multiple times, subject to the available balance, for settlement obligations across days.

According to Sebi, the proposed facility will provide client level settlement visibility — both pay-in or shares that a customer wants to sell and pay-out which are the shares that a client wants to buy — to CC by the direct settlement of funds and securities between the client or investor and CC.

The process safeguards clients’ assets from misuse, brokers’ default and consequent risk to their capital.

Clients’ assets at present pass through the stock broker and clearing member before reaching CC. The pay-out released by CC also follows a similar cycle of passing through clearing members and stock brokers before reaching the client. While CCs provide final settlement instructions to their members each day, it is the stock broker who settles the obligations with clients.

The proposed model will see the block being created by the client using the UPI app based on the blocking request initiated through the stock broker app.

While creating the blocking request under the new mechanism, relevant information such as trading member code, clearing member code and unique client code, will be captured by the broker and sent to UPI. Subsequently, the block will get created in favour of CC and can be debited by CC only.

Under the multiple debits feature of the facility, a block created on the first day, can be partially debited multiple times till the exhaustion of the amount or its expiry, whichever is earlier.

Sebi has sought comments from the public till February 16 on the proposal.

Lava IPO blow

Sebi has returned the draft IPO papers filed by homegrown mobile maker Lava International. It has asked the company to file the documents again with certain updates. The development could lead to a delay in the company’s initial share sale. Lava International had filed the draft red herring prospectus with Sebi in September 2021.