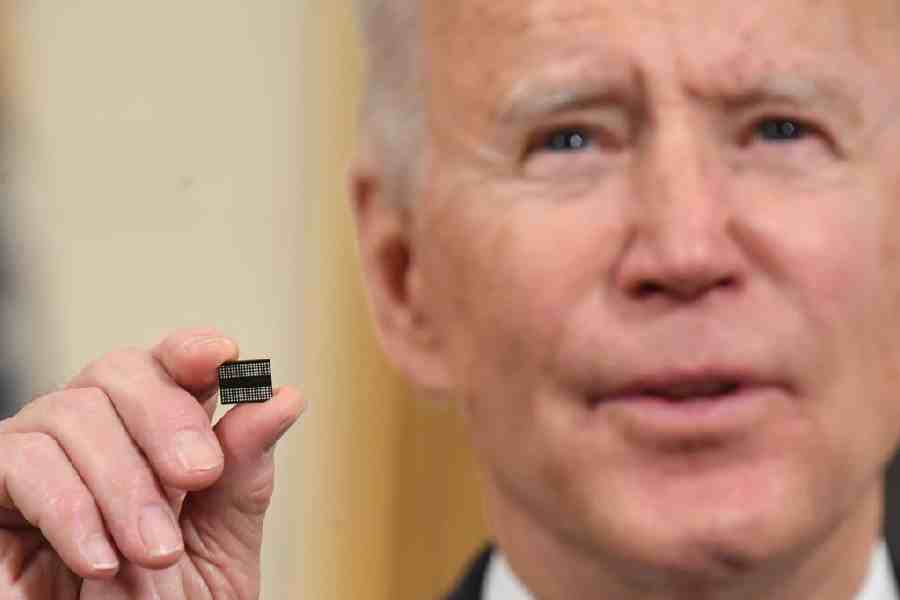

As the US and its allies increase efforts to restrict China's access to advanced semiconductor chips, experts say the measures could impact Beijing's development. But they will also cause collateral damage to US firms.

China's semiconductor industry is facing renewed pressure from the United States and its allies after Japan announced on May 23 that it would impose export restrictions on 23 types of chipmaking technology, including advanced semiconductor manufacturing equipment.

The measure will come into effect in July.

The move comes after the US and the Netherlands introduced similar measures in recent months as Washington and its allies try to limit China's access to advanced semiconductor chips and equipment.

Last October, the US government introduced a series of export controls on advanced semiconductor chips. Since then, Washington has been lobbying the Netherlands and Japan to join its efforts to limit the development of China's semiconductor sector.

How did China react to the move?

In a statement, a spokesperson for the Chinese Commerce Department said Beijing "strongly opposed" Tokyo's decision to impose export control on items related to advanced semiconductor manufacturing, saying the move goes against free trade and international trade regulations and it's an abuse of export control measures.

Some Chinese semiconductor industry executives have expressed concern over the potential impact of Japan's measures and experts said they will "stifle" China's attempt to develop new processes to manufacture advanced semiconductor chips in the future.

"The development of China's semiconductor industry will likely be limited to the 14 nanometers (nm) process, and it will be more difficult for China to move beyond this standard in the future as they won't be able to get advanced equipment from Japan, the US or the Netherlands," Pei-Chen Liu, an expert on the semiconductor industry in Asia Pacific at the Taiwan Institute of Economic Research, told DW.

Nanometer node is related to different generations of chip manufacturing technology and the most advanced chips are around 3 nm, which are mostly for smartphones, while more mature semiconductor chips are around 28 nm or above, which are for vehicles or household electronics.

Since Japan's export control could potentially have an impact on China's semiconductor industry, the latest move could also impact a lot of related industries, and a lot of manufacturers that produce consumer electronics.

"There is no technological achievement more difficult than producing high-quantity commercial chips, particularly when you get into smaller nanometer sizes," said Alex Capri, lecturer at the National University of Singapore (NUS).

He said that as the value chain is dominated by the US, Japan, South Korea, Taiwan, and the Netherlands, they are more "prone to" cooperate with Washington, even though the Chinese market is important for their sales. "If the group of five are engaging in friend-shoring, it's going to be expensive but they will be able to pull that off in the mid- to longterm," he told DW.

However, for China the goal of becoming fully self-reliant in terms of semiconductor manufacturing and development will be an "almost impossible task," Capri continued. "Assuming these alliances hold, this is going to set back China's objectives of becoming totally self-sufficient for years, because it's incredibly difficult."

During a trip to Guangdong Province in southern China in April, Chinese leader Xi Jinping highlighted the importance of pursuing self-reliance in science and technology, emphasizing that the move is crucial to advancing Beijing's modernization efforts. He called on Chinese businesses to take "further steps" to increase innovation capacity and make more progress in "achieving breakthroughs" in core technologies.

China retaliates against US chip company Micron

To retaliate against the US-led export control measures, China's cyberspace regulator announced on May 21 that US memory chip maker Micron had failed the network security review and thus they had banned operators of key infrastructure from buying products from Micron.

During a meeting between top American and Chinese commerce officials, Washington's Commerce Secretary Gina Raimondo raised the issue with her opposite number in Beijing, Wang Wentao. On Saturday, Raimondo emphasized that Washington won't tolerate Beijing's ban on purchases of memory chips from Micron. She said the US firmly opposes China's move against the chip giant.

Following China's decision to bring a halt to memory chip purchases, Micron's Chief Financial Officer Mark Murphy said on May 22 that the company is assessing how the move might affect its sales. "We are currently estimating a range of impacts in the low single digits percent of our company total revenue at the low end, and high single-digit percentage of total company revenue at the high end," he said at a conference.

Some analysts think Beijing's measures against Micron are a "performative move" that may not seriously damage the company's business in China, and that Beijing and Washington may consider adopting these moves because they are politically popular.

Dexter Roberts, a senior fellow at the Atlantic Council's Indo-Pacific Security Initiative, told DW that both China and the US "can take politically popular moves that seem to punish the other side, but don't necessarily have to shut down all businesses between the two sides."

US Secretary of Commerce Raimondo said on Saturday that Washington is working closely with allies to address China's "economic coercion" that targets "a single US company without any basis in fact. We won't tolerate it, nor do we think it will be successful," she said.

Will the export control measures backfire?

While the Chinese government said Japan's export control measures will undermine the interests of Chinese and Japanese companies as well as disrupt the global semiconductor industry, some US semiconductor companies, and foreign governments, have also warned about the potential impact of the coordinated export control measures.

Jensen Huang, the chief executive of American chipmaker Nvidia, told the Financial Times that the US seriously risks damaging its tech industry if it keeps imposing restrictions on trade with China. "If [China] can't buy from… the United States, they'll just build it themselves. So the US has to be careful. China is a very important market for the technology industry," he told FT in an interview published last week.

In addition to the warning from Huang, South Korea has also urged the US to review the criteria for semiconductor subsidies. Seoul is concerned the rules that prevent recipients of US federal funding from building new facilities in countries like China will have a damaging impact on South Korean semiconductor companies.

Capri from the NUS said the US-led measures have created a wide range of collateral damage to American businesses and US citizens, as they are either banned from selling equipment to Chinese companies or prohibited from working for Chinese companies that have been blacklisted by Washington.

"While the US government decides to sanction China, the Semiconductor Industry Association thinks the government needs to do it in a way that doesn't hurt American companies or companies from ally countries too much," said Roberts from the Atlantic Council.

Roberts acknowledged that it's difficult for Washington and its allies to execute these export control measures in a "strategic way" as most companies investing in the US also have strong business interests in China.

"Some US companies are deeply reliant on the Chinese market, and the other thing that complicates matters a lot is the fact that semiconductors are a classic dual-use technology, which means it's hard to determine what to restrict as semiconductors can be used in both everyday applications or weapons systems," he told DW.

Even though Washington's measures have created some collateral damage for American companies, Roberts thinks there may still be some room to facilitate trade between US semiconductor companies and Chinese semiconductor companies without abandoning the export control measures.

"US companies can apply for special licenses and if their applications are approved, they can continue to sell semiconductors or presumably semiconductor manufacturing equipment [to China,]" he told DW. "I would anticipate there to be more examples that can create room to take off some of the pressure."