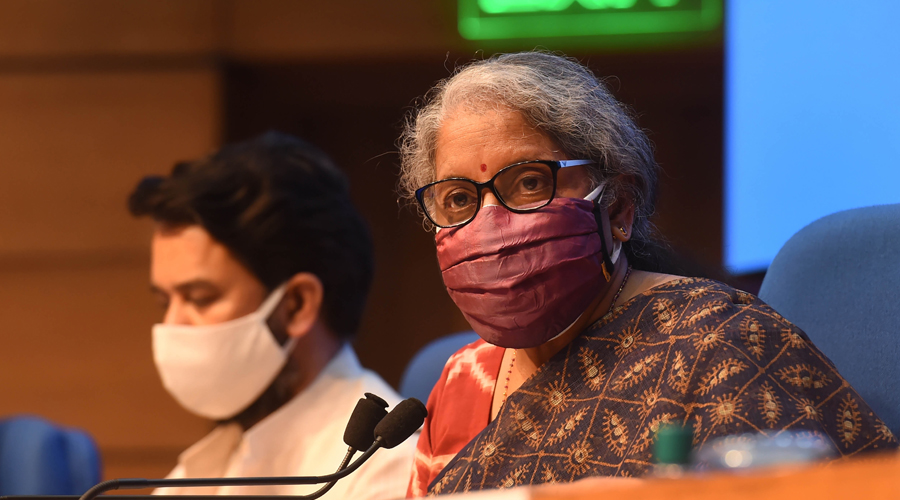

Finance Minister Nirmala Sitharaman on Wednesday said the government will actively pursue cases against economic offenders to bring back defrauded money of banks.

The remark came soon after the Enforcement Directorate (ED) said the Debts Recovery Tribunal (DRT) has sold shares worth over Rs 5,800 crore of United Breweries Limited (UBL) that were earlier attached under the anti-money laundering law as part of an alleged bank fraud probe against fugitive liquor baron Vijay Mallya.

"Fugitives & economic offenders will be actively pursued; their properties attached & dues recovered. #PSBs have already recovered Rs 1357 Cr by selling such shares. A total of Rs 9041.5 Cr shall be realised by banks through sale of such attached assets" the Finance Minister said in a tweet.

According to ED, Vijay Mallya, Nirav Modi and Mehul Choksi have defrauded public sector banks by siphoning off the funds through their companies which resulted in total loss of Rs 22,585.83 crore to the lenders.

The latest sale proceeds, as per the agency, would take the total value of recovery to Rs 9,041.5 crore, or 40 per cent of the over Rs 22,000 crore allegedly defrauded by the trio.

The three, who fled overseas as probes against them gathered pace, are being investigated by central investigative agencies such as the ED and the Central Bureau of Investigation (CBI) after they were alleged to have cheated banks. These frauds have been categorised as among the country's biggest criminal loan heists till date.

The ED gave the low-down on these two cases -- the estimated Rs 13,000 crore fraud allegedly carried out by diamond trader Nirav Modi, his uncle Mehul Choksi and others in the Brady House branch of PNB in Mumbai, and the about Rs 9,000 crore Kingfisher Airlines fraud triggered by Mallya -- in a statement issued here.