The Centre will soon notify rules to set up GST appellate tribunals and appoint members after approval from the GST Council, a senior CBIC official said on Monday.

“We are not following a Big Bang approach, we are working in a calibrated manner. We are in the process of taking more trade-friendly steps. We are in the process of notifying the rules after approval of the Council.

“We will have to set the manpower, and institutions in place. We are hopeful it will be done sooner,” Central Board of Indirect Taxes and Customs (CBIC) member (GST) Shashank Priya said at a Ficci event.

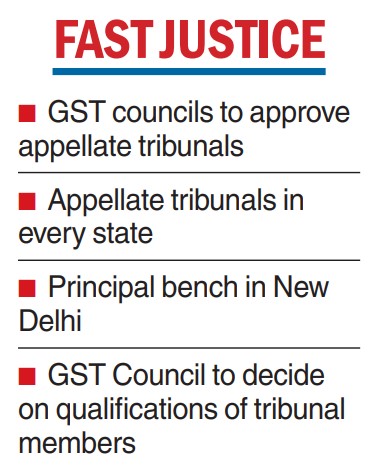

The council will also approve the work experience and qualifications of members of the tribunal.

In March, Parliament had cleared changes in the Finance Bill to pave the way for setting up the appellate tribunals.

There will be benches of the tribunal in every state, with a Principal Bench in Delhi which will hear appeals related to ‘’place of supply’’.

Currently, taxpayers move the high courts against any GST ruling.

The resolution process takes a longer time as the high courts are already burdened with a backlog of cases and do not have a specialised bench to deal with GST.

Setting up of state and national-level benches would pave the way for faster dispute resolution.

Tax base

Priya said the department was working to expand the taxpayer base and doing data triangulation with the income tax department on corporate taxpayers.

The move to widen the tax net comes at a time the Centre is chuffed by the 12 per cent jump in GST collections in June — with collections over the past four months consistently topping Rs 1.5 lakh crore.

The move to triangulate date indicates glaring cracks in the system that haven’t been resolved to date – more than five years after the Modi government launched its biggest tax reform in July 2017.

As per data, currently, only 40 per cent of the corporate income taxpayer base is also registered under GST.

Priya said the board has detected 45,000 fake GST registrations involving evasion of Rs 13,900 crore. The officers have also blocked the wrongful availment of ITC (input tax credit) worth Rs 1,430 crore.