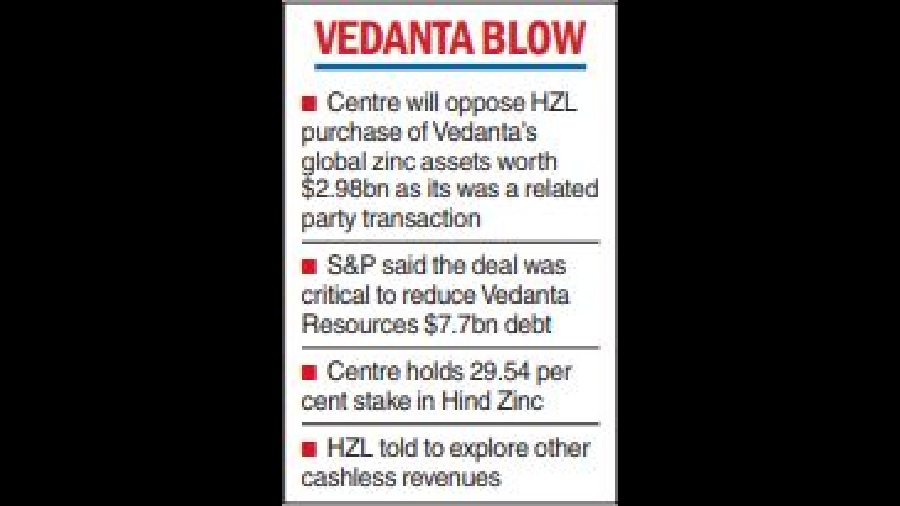

The Centre has opposed the sale of the international zinc assets of Vedanta Limited to Hindustan Zinc Limited for $2.98 billion, dealing a blow to promoter Anil Agarwal’s plans to trim down the mining giant’s $7.7 billion net debt.

In a letter to HZL, posted by the company to stock exchanges, the ministry of mines said the deal is a “related party transaction” and the government would “like to reiterate’’ its dissent.

The government has threatened to take legal action to stop the sale of the Africa-based assets to HZL, in which it holds a 29.54 per cent stake.

HZL shares fell to a month’s low of Rs 320.50 on the NSE and ended at Rs 321, down 0.91 per cent.

HZL in January agreed to buy THL Zinc Ltd Mauritius from its parent, Vedanta Ltd, for $2.98 billion in phases over 18 months.

Vedanta holds a 64.92 per cent equity share of Hindustan Zinc Ltd (HZL), which is an integrated producer of zinc, lead and silver.

HZL in a separate filing said it would place the ministry’s letter before the board and that a meeting of the shareholders to approve the deal was yet to be called.

“We always believe in and operate in perfect manners of corporate governance, so (there is) no deviation on that count,” Hindustan Zinc CEO Arun Misra told CNBC-TV18.

Rating agency S&P Global had said Vedanta Resources’ ability to meet its financial obligations beyond September would depend on a planned $2 billion fundraising as well as the proposed sale of THL Zinc Ltd, a Vedanta Ltd unit that holds zinc assets in Africa.

The ministry in the letter said it is writing on behalf of the government on the resolution approved by the HZL board in its meeting on January 19 “for the creation of a wholly-owned overseas subsidiary of the company, funding such subsidiary to the extent of $2.981 billion and such subsidiary acquiring the shares of THL Zinc Ltd from THL Zinc Ventures Ltd (an entity of the Vedanta Group)”.

It said its nominee directors on the board had recorded their dissent to the proposal.

“The proposed resolutions which envisage the acquisition of THL Zinc (a Vedanta company) by HZL (also a Vedanta company) thus being a related party transaction, we, the government of India would like to reiterate our dissent on the matter and the resolutions forming part of the agenda matter,” it said.

It wanted the company to explore other cashless methods of acquisition of assets.

The government, it said, would continue to oppose the transaction and “will explore all legal avenues available. The company is requested to not take any further action in relation to such resolutions”