The Centre on Friday announced the inclusion of 2.5 crore retail and wholesale traders within the category of MSMEs, meaning they can get loans from banks and financial institutions under the RBI’s priority sector lending rules.

The announcement was made in a tweet by MSME minister Nitin Gadkari. “Retail and wholesale trade were left out of the ambit of MSMEs.

Under the revised guidelines, MSME (ministry) has issued an order to include retail and wholesale trade as MSME and extend to them the benefit of priority sector lending under RBI guidelines,” the minister tweeted.

Retail and wholesale trade were left out of the ambit of MSME. Under the revised guidelines, MSME has issued order to include retail and wholesale trade as MSME and extending to them the benefit of priority sector lending under RBI guidelines. #MSMEGrowthEngineOfIndia

— Nitin Gadkari (@nitin_gadkari) July 2, 2021

Though the Confederation of Indian Traders (CAIT) welcomed the decision, its counterpart in the MSME slammed the move as it would bloat the number of players in the MSME field, making it difficult to monitor the sector and provide support.

The Consortium of Indian Associations, which represents the MSME sector, said the move was not the right strategy.

“It is a disastrous move that will dilute the MSME sector that is already quite vast and struggling for its survival. Good quality MSME data is nearly absent in the country, and including over 2.5 crore traders and retailers will further complicate the issue,” the association’s convenor K.E. Raghunathan said.

He said it would be difficult to collect data on MSMEs according to industry in each state and district. “It will also be difficult to estimate and analyse the problems prevailing in each sector, thereby making it difficult to introduce the right provisions at the right time,” he added.

The government had last year changed the definition of MSME, categorising them on the basis of turnover rather than investments.

It had also abolished the distinction between the manufacturing and services sector that would allow the MSMEs to grow in size while continuing to avail of the benefits.

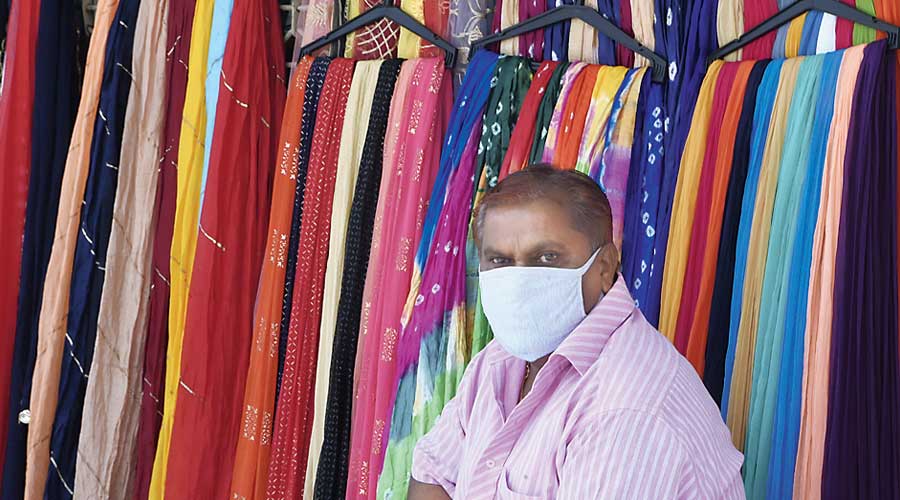

“The Covid pandemic-affected traders will now be able to restore their businesses by obtaining necessary finances from the banks which was earlier denied to them,” Praveen Khandewal, secretary-general of CAIT, said.

“We have to see the fine print to see whether the trading community would be eligible for the emergency credit line guarantee scheme. If there is no clarity we would seek from the finance ministry,” Khandelwal said.