The Centre on Wednesday announced yet another loan outreach programme in October, with bank credit growth remaining as flaccid as ever after the Modi government’s much tom-tommed loan mela less than two years ago in September 2019.

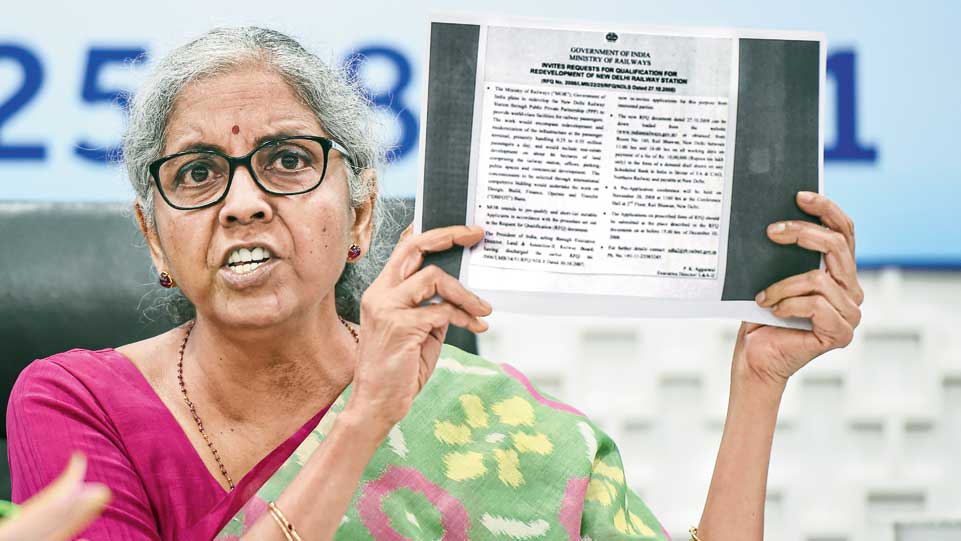

“I think it is too early to conclude whether there is a lack of demand. Even without awaiting indications, we have taken steps to ramp up credit,” finance minister Nirmala Sitharaman told reporters in Mumbai where she is reviewing the performance of PSU banks. A report by CARE Ratings shows credit growth slouching at 5-6 per cent rate since March last year, way below the smart double digit growth that prevailed till June 2019.

While announcing the district-wise loan outreach programme by the PSU banks, the finance minister said there was a need to ramp up credit growth in the eastern pockets of the country in states such as Jharkhand, Bengal and Odisha.

Banks have also been asked to create state-wise plans for northeastern states to help the logistics sector and exporters.

“The government will have a bare minimum presence in the strategic sectors. Banks and financial services have been identified as strategic sectors. The government will look at amalgamating or selling government stakes in insurance firms over and above a bare minimum presence,” Sitharaman said.

Finance secretary T.V. Somanathansaid the government is considering insurance bonds as an alternative to bank guarantee. Guarantees are usually asked for extending a loan and typically require a collateral. An insurance bond is also a surety but does not require any collateral.

The government may also introduce legislative amendments in the budget session of Parliament to enable Indian companies to directly list certain prescribed classes of securities abroad. “There are certain issues which need to be sorted out for this to become a success,” revenue secretary Tarun Bajaj said on Wednesday.

Sitharaman also unveiled the fourth edition of the Public Sector Bank (PSB) Reforms Agenda “EASE 4.0” for 2021-22.