Stocks kicked off the week on a poor note — hit by rising oil prices on account of the new cap on Russian crude and the relaxation in China’s Covid restrictions.

In volatile trade on Monday, the BSE Sensex after falling 360.62 points to 62507.88, ended with a 33.9-point loss to settle at 62834.60.

The broader NSE Nifty finished with marginal gains to end 4.95 points or 0.03 per cent higher at 18701.05.

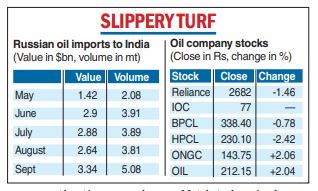

The cap by Western nations on Russian oil price at $60 per barrel spoiled the investor mood. Russia is the world’s second-largest producer of crude oil, with India taking advantage of the low prices to import heavily from that country.

Rising crude prices hit the Reliance stock, which was the biggest loser on the BSE, down 1.46 per cent. After the war broke out, Reliance snapped up Russian crude and recent reports indicate, the oil giant has bought Russian naphtha.

Other oil company stocks also traded weak with the HPCL counter taking a knock of 2.42 per cent and BPCL, 0.78 per cent.

Global oil prices were also bullish as Opec+ maintained its output targets at a meeting on Sunday. Brent crude was trading higher by nearly 2.80 per cent at $87.95 a barrel on Monday.

Falling oil prices were a big reason for indices hitting record levels. Amid valuation concerns at least in some pockets, analysts feel stocks could remain under pressure if the commodity becomes dearer.

Market circles added that investors were cautious as they awaited the monetary policy announcement on Wednesday and the outcome of the Gujarat state elections.

Metal stocks gained on expectations that easing Covid restrictions in China could revive demand.

While the BSE metal index jumped 2.37 per cent, Hindalco climbed 4.46 per cent even as Tata Steel was the largest gainer in the Sensex pack rising 3.35 per cent.

“We expect the market to consolidate for the next few days given the RBI policy on Wednesday and Gujarat election outcome on Thursday. Tomorrow (Tuesday) we might see some reaction based on Gujarat exit poll data today,’’ Siddhartha Khemka, head — of retail research, at Motilal Oswal Financial Services said.

Osho Krishan, Sr. Analyst — technical & derivative research — Angel One — said that the domestic markets were likely to remain upbeat in the near term, and any minor dip could be seen as an opportunity for the bulls to add long bets.

“We may expect gradual moves in key indices, but individual pockets are performing well. Hence, it’s advisable to keep focusing on such potential movers, which are likely to provide better trading opportunities,’’ he said.

Meanwhile, the rupee pared its initial gains to settle down 58 paise at a nearly two-week low of 81.79 against the dollar on Monday weighed down by weak domestic markets and a rise in crude oil prices.

MPC meet starts

The RBI’s rate-setting panel on Monday started brainstorming for the next round of monetary policy amid expectations of a moderate interest rate hike of 25-35 basis points as inflation has started showing signs of easing and economic growth tapering.

RBI governor Shaktikanta Das will announce the bi-monthly monetary policy on Wednesday (December 7).