Byju’s three global investors have confirmed the resignation of their representatives on the company’s board.

On Thursday, while its former auditor Deloitte Haskins & Sells resigned, there was also news of three of its board members resigning.

Byju’s had then vehemently denied the resignation of the trio even as it had appointed BDO (MSKA & Associates) as the statutory auditor for a period of five years beginning 2021-22.

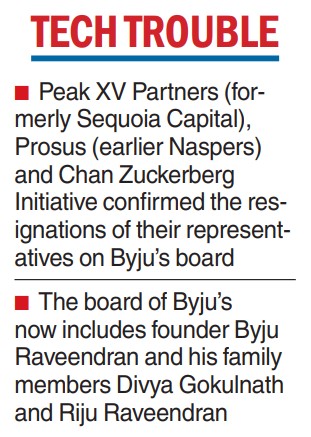

However, on Friday, the three global investors, which included Peak XV Partners (formerly Sequoia Capital), Prosus (earlier Naspers) and Chan Zuckerberg Initiative, confirmed the resignations of their representatives.

“We confirm that G.V. Ravishankar, MD, Peak XV Partners, has resigned from the board of Think & Learn Pvt Ltd. We are committed to supporting the company for bringing on board an independent director in order to strengthen business processes and internal control mechanisms,” a spokesperson of Peak XV Partners, said.

Similarly, Prosus, which holds nearly 9.70 per cent, confirmed the resignation of Russell Dreisenstock, while Vivian Wu of the Chan Zuckerberg Initiative resigned from the board of the holding company Think & Learn Pvt Ltd.

Due to these resignations, the board of Byju’s now includes founder Byju Raveendran and his family members Divya Gokulnath and Riju Raveendran.

Byju’s said in a statement that it is engaged in constructive discussions with investors on the reconstitution of its board and this includes the induction of independent director.

It pointed out that the “need for reconstitution arose as a few investors had to vacate their board seat due to their shareholding falling below minimum required threshold’’. However, the edtech firm did not elaborate on what this threshold was.

“We reassure all stakeholders the company is actively working towards constituting a diverse and a world-class board commensurate with the company’s size and scale,” its spokesperson added.

The development comes after the resignation of Deloitte as the statutory auditor of Byju’s citing a delay in submission of financial statements. In a letter sent to the board of Think & Learn, Deloitte said it has not been able to start an audit due to the delays and that will have a “significant impact” on its ability to “plan, design perform and complete” the audit according to the standards.

Earlier, Byju’s had skipped a $40 million repayment due and had sued its lenders over alleged harassment in the recovery of the loan. It had filed a suit against Redwood saying the US entity purchased a significant portion of the loan while primarily trading in distressed debt, which was contrary to the conditions of the term loan facility.

Byju’s had then said that it has elected not to make further payments on the $1.2 billion ‘term loan B (TLB)’ and that it had filed a suit in the New York Supreme Court.