Telegraph Infographic

The RBI’s decision to hold policy rates on Friday sent a shockwave across the bourses as jittery and bruised investors, who expected at least a 25-basis-point hike, dumped stocks in anger and frustration.

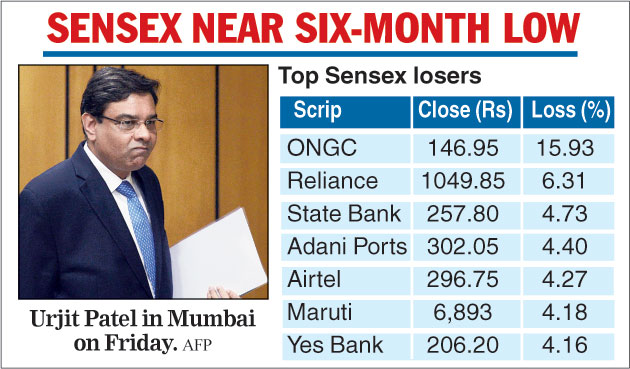

The Sensex, the BSE bellwether, tanked almost 800 points as foreign institutional investors sold Indian equities with a vengeance. The Sensex closed at a near six-month low of 34376.99 even as the broader NSE Nifty dropped 282.80 points to 10316.45.

Foreign portfolio investors were net sellers worth Rs 3,370 crore, while the advance-decline ratio on the BSE was 674 to 1,982.

Market circles blamed the carnage on various factors. While the central bank stood pat on rates that would have otherwise provided some succour to the rupee, comments by RBI governor Urjit Patel on the currency’s depreciation accentuated the fall.

The bi-monthly monetary policy also saw the Reserve Bank changing its policy stance to “calibrated tightening” from “neutral” which meant that a policy rate cut was not on the horizon.

The RBI also came down heavily on non-banking finance companies for their reliance on short-term funds, adding that the norms for the sector would be tightened. The announcement led to a huge selling in these counters.

Shares of oil marketing companies — Indian Oil, BPCL and HPCL — fell over 25 per cent as the Centre’s decision to ask them to absorb part of the price cut in petrol and diesel was seen as a return to government control over pricing.

“The decision to maintain status quo on policy rates and the suggestion that inflation risk has come off despite rising crude oil and falling rupee are key positive highlights from the RBI policy review meet. However, the financial markets reacted negatively largely because of the absence of any specific policy measure to support the rupee and a clear intent to strengthen the regulatory norms of NBFCs. From investors’ point of view, the de-rating of NBFCs could further accentuate,” Gaurav Dua, head of research, Sharekhan BNP Paribas, said.

The 30-share index which opened at 35097.99, slipped below the 35000-mark in early part of the trade itself. Following the RBI’s announcement, the index plunged to a low of 34202.22 before finally closing 792.17 points, or 2.25 per cent, down at 34376.99. This is its lowest closing since April 23, when it had ended at 34450.77 points.

Barring four stocks, the rest of the Sensex pack ended in the red. ONGC was the top loser in the Sensex pack, tumbling 15.93 per cent, followed by RIL at 6.31 per cent.

The NSE Nifty, too, tanked 282.80 points, or 2.67 per cent, to 10316.45 points.