- Personal Income Tax: Standard deduction for those under new regime raised from Rs 50,000 to Rs 75,000

- New tax slabs - No tax up to Rs 3 lakh, Rs 3-7 lakh at 5%, Rs 7-10 lakh at 10%, Rs 10-12 lakh at 15%, Rs 12-15 lakh at 20% and above Rs 15 lakh 30%

- Salaried employee in new tax regime will save up to Rs 17,500 in income tax

- Corporate tax rate on foreign companies reduced to 25%

- Family pension: enhanced from Rs. 15,000 to Rs. 25,000

- Four crore to receive benefit under the new tax regime

- Long-term capital gains on all financial and non-financial assets will attract a tax rate of 12.5%. Additionally, the limit of exemption for capital gains will be set at Rs 1.25 lakh per year.

- Market borrowing remains the same at Rs. 14.13 lakh crore

- Abolition of angel tax

- The customs duty on gold and silver will be reduced to 6%, while the duty on platinum will be lowered to 6.4%.

- Decriminalise delay of filing IT returns

- Direct taxes: Comprehensive review of the Income Tax act 1961 in six months

- Two tax exemption regimes for charities to be merged

- Customs duty: Undertake a comprehensive review in the next six months

- To promote domestic aviation and boat and ship maintenance extend the period of export of goods imported ror repairs from six month to one year

- Cancer medicines: Three more medicines exempt from Custom duties, X-ray plates

- Indirect taxes: GST has enhanced revenues of centre and state. Strive to further rationalise

- Fiscal deficit estimated at 4.9 per cent of the GDP

- Mobile phone and related parts: reduce Mobile phones and chargers BCD to be reduced by 15 per cent

- Marine products: reduce BCD on brood stock, shrimp and fish feed.

- Leather and textile: reduce BCD on down filling materials from ducks and goose

- Increase BCD on ammonium nitrate from 7.5 per cent to 10 per cent

- Govt to provide Rs 11,500 crore to Bihar for flood mitigation

- For enhancing ease of doing business Jan Vishvaas Bill being readied

- Shram Suvidha and Samadhan portal for labour to be revamped

- Natural disaster-hit Uttarakhand, Sikkim, Himachal Pradesh, Assam financial assistance for reconstruction to be provided

- Rs 11.11 lakh crore has been allocated for capital expenditure, which amounts to 3.4% of India's GDP.

- Land records in urban areas to be digitised

- Road connectivity to 25,000 rural habitation

- Venture capital fund of Rs. 1000 crore for space economy

- Nuclear energy: partner with private sector for setting up Bharat small reactor and R&D of new technology. Funds to be made available.

- Investment in infrastructure by private sector, a market-based framework to be worked out.

- Road connectivity to 25,000 rural habitation

- Rs 2.2 lakh crore to make housing more affordable

- Stamp duties: Ask states to lower stamp duties on properties purchased by women

- Cities as growth hubs: Formulate a policy for economic and transit planning, creative redevelopment of cities, with population over 30 lakh

- Critical Mineral Mission for domestic production, recycling and acquisition of critical mineral from abroad

- Budget provides Rs 2.66 lakh crore for rural development

- Limit of Mudra loans to be enhanced to Rs. 20 lakh from the existing Rs 10 lakh for those who have repaid

- A comprehensive scheme for internship in top 500 companies for 1crore youth in five years

- Internship allowance of Rs. 5,000 per month and one-time pay of Rs. 6,000

- Credit guarantee schemes for MSMEs, purchase of machines a credit guarantee scheme to be introduced, up to a Rs.100crore. Borrower will have to provide a guarantee fee

- Banking services to be expanded in North-East

- Three crore additional houses under PM Awas Yojana

- Funds for essential infrastructure to be provided for Hyderabad-Bangalore industrial corridor

- Rs 26, 000 crore for Patna-Purnea Expressway, two bridges on Ganga at Buxar and other infrastructure projects in Bihar

- Purvodaya for the all-round development of Bihar, Jharkhand, West Bengal Odisha and Andhra Pradesh

- Amritsar-Calcutta industrial corridor: industrial node to be set up at Gaya

- A financial support for loans up to Rs. 10 lakh for higher education in domestic institutions

- 1,000 training institutes to be upgraded in line with the emerging needs of the industries

- A new centrally sponsored scheme for skilling for 20 lakh youths over five year

- Participation of women: hostels and creches to be established

- 10,000 need-based bio-input centres to be established

- Rs. 1.48 lakh crore for employment, education and skilling

- Rs.1.52 lakh crore for agriculture and allied sector

- One-month wage to first-time employees about Rs. 15,000 in three instalment

- We need to focus on the poor, women, youth and farmers

- Productivity and resilience in agriculture: government to promote climate resilient varieties of 32 field and horticulture crops to be released

National Cooperation Policy on anvil: FM

The government will bring a National Cooperation Policy for the overall development of the country, Finance Minister Nirmamala Sitharaman said on Tuesday. Presenting the Budget for 2024-25, she said the Centre will promote digital public infrastructure for agriculture in partnership with states, while Jan Samarth-based Kisan Credit Card will be introduced in five states. Besides, the government will strengthen production, storage and marketing of pulses, while fast-track growth of rural economy and creation of employment opportunities will be the policy goal, she said. Also, the government will provide finance for shrimp farming and marketing, she added.

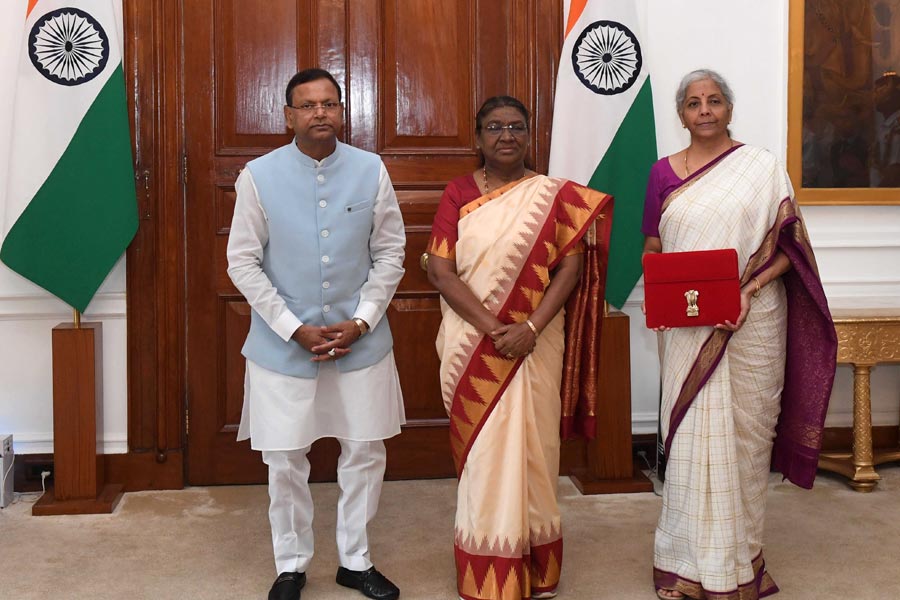

Nirmala Sitharaman presents Budget for 2024-25

Finance Minister Nirmala Sitharaman presented the Budget for 2024-25, her 7th straight presentation surpassing the record of former prime minister Morarji Desai. This is the first Budget during Prime Minister Narendra Modi-led government's third term in office. People of India have reinforced their faith in the government led by Modi and re-elected it for the third term, she said, while presenting the Budget in Lok Sabha. India's economic growth continues to shine while the global economy is still in the grip of policy uncertainty, Sitharaman added. The country's inflation continues to be stable and is moving towards 4 per cent, and core inflation stands at 3.1 per cent.

Cabinet clears Union Budget 2024-25

The Union Cabinet headed by Prime Minister Narendra Modi approved the full budget for 2024-25, sources said. Following this, Finance Minister Nirmala Sitharaman will present her seventh budget in the Lok Sabha. Sitharaman, the first full-time woman finance minister of the country, has presented five full budgets since July 2019 and an interim budget on February 1, 2024. This is the first budget of the BJP-led NDA government in its third term in office.

Budget for world's fastest-growing economy

Finance Minister Nirmala Sitharaman will on Tuesday present her 7th straight Budget that would lay a roadmap for Viksit Bharat (developed India) by 2047, while giving a glimpse of the Modi government's performance in the past 10 years.

All eyes will be on whether Sitharaman provides the much-expected tax relief for the middle class, leaving more money in their hands, as there is tax buoyancy. Besides, the market also expects staying on the fiscal glide path to lower the fiscal deficit to 4.5 per cent of GDP by 2025-26.

Sitharaman, who would be presenting her seventh straight budget, had in her first Budget in 2019 replaced the leather briefcase -- which had been in use for decades for carrying Budget documents -- with a traditional 'bahi-khata' wrapped in red cloth. This year's Budget would be in paperless form, as done in the last three years.

Here are the key numbers to watch out for the first full Budget of Modi 3.0:

- Fiscal Deficit: The budgeted fiscal deficit, which is the difference between the government expenditure and income, for the current fiscal is 5.1 per cent as projected in the Interim Budget in February, against 5.8 per cent in the last fiscal year. The full Budget is expected to provide better-than-earlier projections as there has been tax buoyancy.

The government has projected fiscal deficit at 4.5 per cent of the GDP in FY26.

- Capital Expenditure: The government's planned capital expenditure for this fiscal year is budgeted at Rs 11.1 lakh crore, higher than Rs 9.5 lakh crore in the last fiscal year. The government has been pushing infrastructure creation and also incentivising states to step up capex.

- Tax Revenue: The Interim Budget had pegged gross tax revenue at Rs 38.31 lakh crore for 2024-25, an 11.46 per cent growth over the last fiscal. This includes Rs 21.99 lakh crore estimated to come from direct taxes (personal income tax + corporate tax), and Rs 16.22 lakh crore from indirect taxes (customs + excise duty + GST).

- GST: Goods and Services Tax (GST) collection in 2024-25 is estimated to rise to Rs 10.68 lakh crore, an increase of 11.6 per cent. The tax revenue figures will have to be watched out for in the final Budget for the 2024-25 fiscal year.

- Borrowing: The government's gross borrowing Budget was Rs 14.13 lakh crore in the current financial year as per the Interim Budget. The government borrows from the market to fund its fiscal deficit. The borrowing number will be watched by the market, especially on the back of more-than-expected dividend from the RBI and financial institutions.

- Nominal GDP: India's nominal GDP growth (real GDP plus inflation) in the current fiscal year is estimated to be 10.5 per cent to Rs 327.7 trillion as per the Interim Budget. In view of the expected normal monsoon, improvement in revenue collections and pick up in rural consumption, is expected that there could be an upward revision in growth estimate. Real GDP growth in the current fiscal is projected at 7.2 per cent, as per the RBI.

- Dividend: The interim Budget had projected Rs 1.02 lakh crore from RBI and financial institutions. This will be revised upwards as the RBI has already made surplus transfer of Rs 2.11 lakh crore earlier in May.

At the same time, Rs 43,000 crore is expected to be garnered from Central Public Sector Enterprises (CPSEs).

- Spotlight would also be on spending on key schemes like NREGA as well as key sectors like health and education.