IT changes are exciting

Lipa Sen (32) and Nabarun Bhattacharjee (32) tied the knot during the pandemic. Lipa is a computer laboratory assistant in a government college, while Nabarun teaches computer science at a private school in Calcutta. Lipa and Nabarun are fed up with the abrupt rise in the prices of essential medicines of their elderly parents. They think urgent steps should be taken in this respect and are hoping that the government should increase preventive health checkup exemption from Rs 5,000 keeping in mind the rising medical spend. Prices of general commodities are rising too. The income slabs are to some extent all right according to them but they hope that the budget would raise the standard deduction limit from Rs 50,000 to Rs 75,000. They are hoping that the budget should focus more on research and the government should spend more on education. They also feel that further exemptions on mutual funds could also nudge them to make more investment and hope that both the TDS threshold of Rs 5,000 in case of dividends and long term capital gains threshold of Rs 1 lakh are revised in the union budget.

Budget reaction

We are excited that the budget has offered some tax relief. But not much has been done for the taxpayers on the healthcare expenses exemption. It seems that the government is looking to discourage investment in financial products where there are tax benefits and this will induce expenditure rather than encourage savings.

Focus on youth

Tamalika Roy (24) is an assistant system engineer at an MNC. She invests in EPF to save on tax as the accumulated fund as well as the interest is taxfree. The year 2022 saw a downfall in crypto so Tamalika hopes that crypto will be considered as an asset that will start to get parity with other assets such as gold and stocks. Further, she hopes the government would consider lowering TDS on crypto assets.

She will also keenly watch on whether there are any announcements related to the Central Bank Digital Currency. In the last few years, India has emerged to be one of the most preferred destinations for start-ups, hoping that the government will continue to maintain this business environment as start-ups have created more than 7 lakh jobs in the past few years, she added.

Budget reaction

The government has announced an extension in the date of incorporation of startups for income tax benefits by one year which was actually sought by the startups. However, there is nothing much for the income tax payers who avail of exemption. The good thing in this budget is the focus on the youth and t a few schemes for training and skill development that have been announced. The finance minister has also spoken about Make AI in India, which includes creation of centre of excellence in top educational institutes. Hopefully this will give a boost on creating an effective AI intelligence ecosystem.

Room for more change

Amrik Majumder (23) is a software development engineer at one of the Big 4 accounting firms. He has opened a PPF account to save on taxes apart from his EPF investment. He gets some tax breaks under section 80D for his mediclaim premium. Amrik feels that most of the deductions under sections 80C, 80D and HRA have been standard for quite some time and for almost eight years the exemption limits have been Rs 2.5 lakh. “Being a new tax-payer I really hope the exemption limits will be increased. It will be great news for the salaried class if the 80C limit is raised from Rs 1.5 lakh to Rs 2.5 lakh and new non-taxable elements are included in the salary structure. I believe any taxpayer would expect the deductions for each tax slab to be modified keeping in mind the current inflation rate and increase in medical premiums which are a drag on taxpayers’ savings”.

Budget reaction

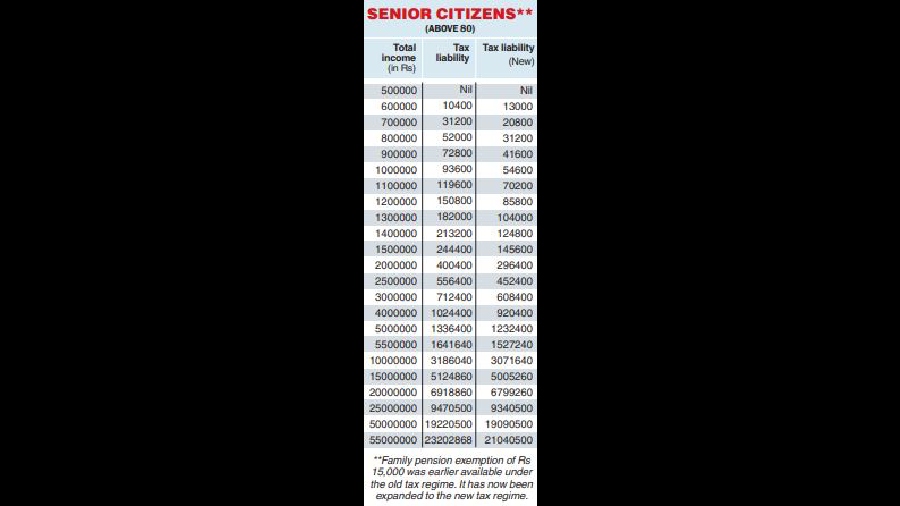

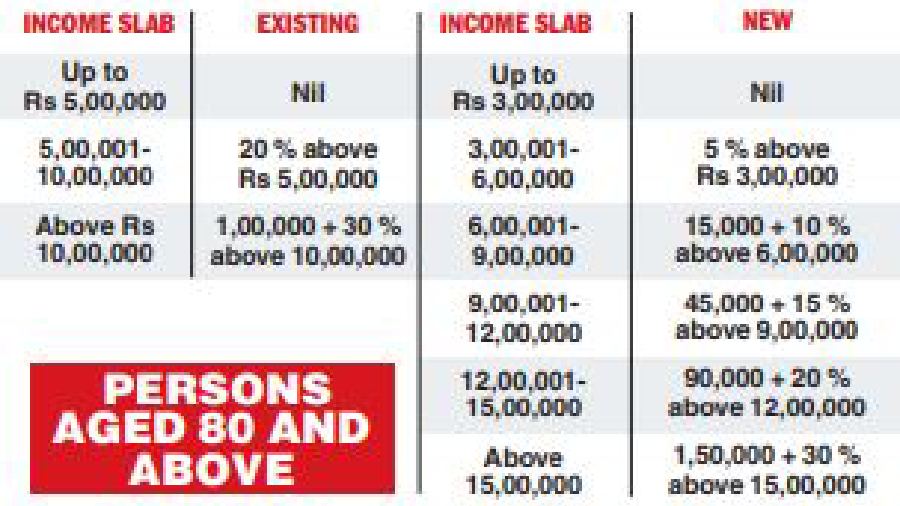

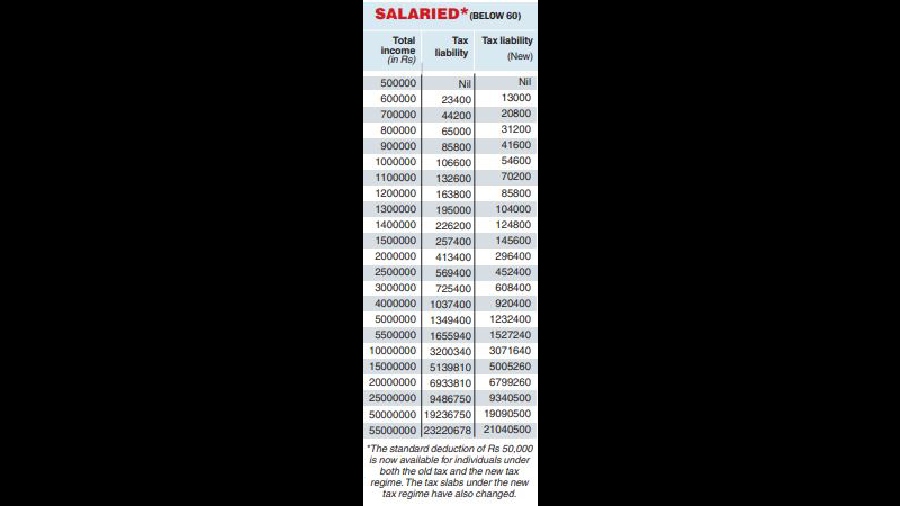

The new tax regime in this year’s budget finally brings a change in tax slab by increasing the rebate limit to Rs 7 lakh and starting the deduction from the Rs 3-6 lakh range, helping the common taxpayers to save some money. Although I had hoped for the deduction limit under section 80C to increase from the Rs 1.5 lakh mark, it has not happened this year. However, I hope to see that change next year. It remains to be seen what is the impact of the proposal where life insurance policies other than ULIPs are taxed if the aggregate premium is above Rs 5 lakh.

Sops for MSMEs, handicraft welcome

Sonali Chakraborty (42) is a social entrepreneur. She runs an NGO for rural artisans and an artisan-led fashion brand Deshaj. Sonali feels the government needs to extend its support to bolster the craft clusters, including craftbased responsible tourism, skill-oriented training, advanced support systems and craft excellence centres. Structural changes need to be made and GST on crafts should be removed to expand the craft market to more varied customers. The government should encourage the new generation of artisans with advanced technology in their respective crafts. More thought is needed to provide health benefits to smallscale producers. The Centre should focus more on its role to promote local crafts.

Budget reaction

The scope of credit for Micro and Small Enterprises to be facilitated under the Credit Guarantee Trust is good. Raising and accelerating MSME performance, extending the limit for MSMEs and professionals to avail presumptive and raising tax exemption may be beneficial. The finance minister has also allowed deduction for expenditure incurred on payments made only when the payment is actually made. The proposal of an entity digilocker for MSMEs for storing and sharing documents with banks and regulators and business entities could also be useful. A proposal for Unity Mall for one product, one district assignment is a welcome step. A package of assistance for art and handicraft is a welcome move. On the personal income tax side there is not much to talk about unless one is in the new tax regime.

An election-oriented budget

Dr Santanu Gupta (46) is a dental surgeon. In order to save tax he usually invests in PPF, LIC and ELSS. As a full-time medical practitioner, Santanu would love to see a good amount of allocation in the healthcare sector. In the post-Covid era, this is all the more significant. The government should create a universal healthcare system with a strong public sector investment. He would also like to see some intervention in reducing the GST paid by healthcare providers. For a dental surgeon who runs his private clinic, Santanu had to invest a lot to set up the state-of-the-art infrastructure. “Every month, we buy materials and equipment. This is a recurring cost and a huge amount is paid as GST. This is an additional burden on us. Some rationalisation of taxes, tax rates and GST will go a long way to help us and the healthcare sector in India. The Covid-19 experience is reason enough to promote universal access to health,” he said.

Budget reaction

This time the government has simplified the slabs in the new tax regime, which might bring a smile on the faces of the middle class. But there is no such clear effort in bringing inflation under control. There is no announcement on cutting GST on most essential commodities like medicines. Petroleum product price management is still in the dark. There is no big announcement in healthcare which is very disappointing. Some hope for senior citizens (MIS and SCSS). However, for me this budget is nothing but an election-oriented budget, which seems to be beneficial for some people but in long run country’s economy is still under threat.

No exemptions for us

Mohammed Ashraf (48) and Heena (44) live in Calcutta. Their son Abban (14) is in seventh grade. Ashraf is a senior manager in a leading financial institution while Heena is a homemaker. Ashraf and Heena have a lot of expectations from the budget — reduction of income tax rates in different slabs will help reduce the overall tax amount, they feel. The basic exemption limit should be raised. Ashraf feels the high incidence of taxes eats into the disposable income of individuals and they in turn cut their spending on things important to improve efficiency. Heena says: “Accommodation is very expensive in the city. We are spending a good amount on our son’s education too. But the exemption under the education head is very low.” Buying a home is on their wish list but high interest rates are a deterrent. They are also hoping that the maximum deduction on home loan interest should be raised from Rs 2 lakh per year to Rs 3 lakh per year regardless of the property cost.

Budget reaction

We were hoping for more exemptions, but there is no change for taxpayers who avail of exemptions. The budget could have focussed on allowing more disposable personal income in the hands of the households, but only those under the new tax regime will benefit. The finance minister has also capped the capital gains deduction on investment in home to Rs 10 crore.

Some help for seniors

Roma Dutta (72) is a retired assistant professor. She invests in tax-saving FDs and PPF. As a senior citizen, Roma sincerely hopes the finance minister will offer some benefits like reducing taxes on essential items such as medicines, food, groceries and building materials. This is particularly crucial due to high inflation of daily consumables as well as medicines. She also hopes that the aggregate threshold of interest income from deposits by senior citizens in savings bank accounts, FDs and RDs for the purpose of tax deduction at sources should be enhanced to Rs 75,000 or Rs 1 lakh. She also hopes that with medical insurance premiums on the rise, there is a need to enhance the maximum exemption of Rs 50,000 on mediclaim. She also hopes that the government spends more on both primary and secondary education.

Budget reaction

It is a welcome move that the senior citizens have been considered by the finance minister in the budget and the maximum deposit limit for SCSS will be enhanced from Rs 15 lakh to Rs 30 lakh. However, there are no concessions for taxpayers availing exemptions and the focus is primarily on the new income tax regime. Some benefits on the mediclaim which is necessary given the rising costs was not considered in this budget. The FM as also given emphasis on teachers’ training, which is good.