Brookfield, the global investment firm, has closed a deal to acquire a 51 per cent stake in Bharti Enterprises’ four commercial properties, at an enterprise value of Rs 5,000 crore.

The transaction was announced early last year.

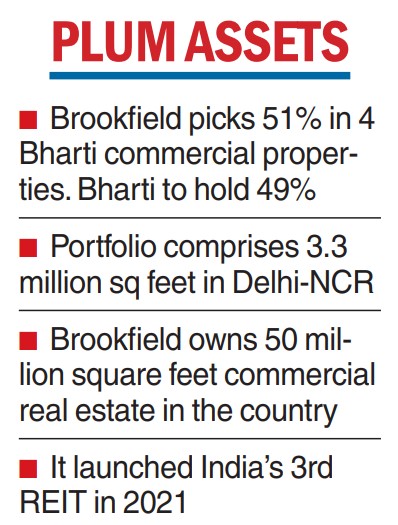

Bharti Enterprises and Brookfield Asset Management said in a joint statement that they have successfully completed their joint venture agreement for a 3.3 million square feet portfolio of commercial properties primarily located in the Delhi-NCR region. The properties include Worldmark Aerocity (Delhi), Worldmark 65, Airtel Center (Gurgaon) and Pavillion Mall (Ludhiana).

"As part of this deal, a Brookfield-managed private real estate fund now owns a 51 per cent stake in this joint venture, while Bharti Enterprises continues with a 49 per cent stake,’’ the statement said.

The joint venture agreement had envisaged Brookfield’s real estate operating arm, Brookfield Properties, managing the assets.Worldmark Aerocity is one of the leading best-in-class mixed-use properties in Delhi NCR with a diverse tenant roster comprising marquee financial services firms, global conglomerates and reputed government undertakings.

Airtel Center is a corporate facility located in North Gurgaon, while Worldmark 65 is another mixed-use asset in South Gurgaon.

Bharti Realty Ltd is the real estate arm of Bharti Enterprises, which has a presence in telecom, real estate, insurance, hospitality, and food businesses.

The realty arm has developed over 5 million square feet of Grade-A commercial real estate with a diversified product mix of commercial, retail and lifestyle.

Bharti Realty will continue to own and operate its remaining commercial assets, which include about 10 million square feet of upcoming development in Delhi Aerocity and will remain focused on developing premium quality commercial real estate development in key locations.

“Bharti will continue to invest substantially to develop more real estate assets to serve the growing demand for well-managed commercial real estate in India. With a pipeline of more than 10 million square feet, this deal will become the template for the yielding and developed assets’’, Harjeet Kohli, joint managing director, Bharti Enterprises, said while commenting on the development.

Brookfield launched India’s third real estate investment trust (REIT) in 2021 after successfully raising Rs 3,800 crore through an initial public offer.

In India, Brookfield owns and operates over 50 million square feet of commercial real estate assets in Delhi NCR, Mumbai, Bangalore, Chennai, Pune, Hyderabad and Calcutta.

"High-quality real estate in global gateway markets and in particular, the Indian office market, continue to witness high demand from occupiers. We look forward to leveraging our global expertise to build future-ready office environments in India,’’ Ankur Gupta, managing partner, head of real estate, APAC region and country head — India, Brookfield, said.