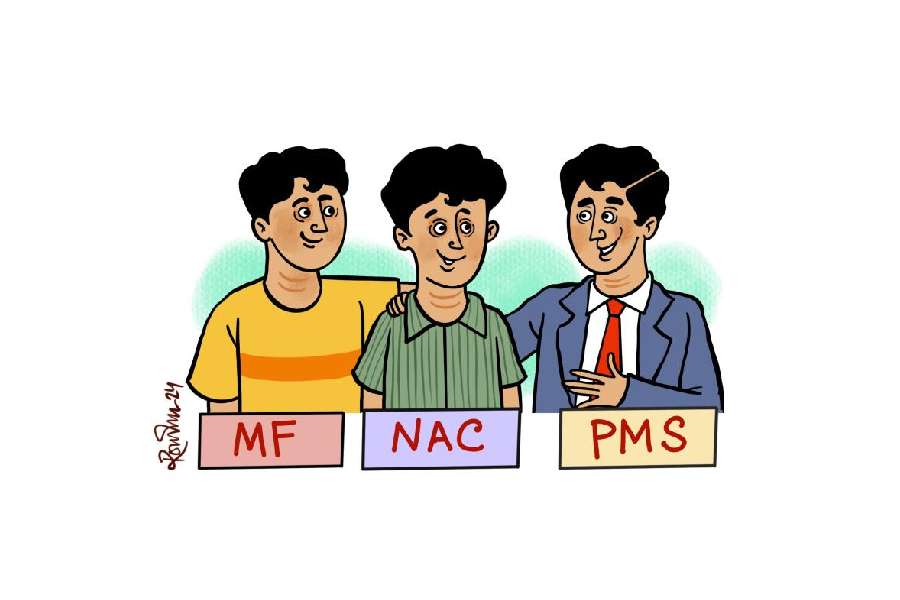

The hoi polloi and the bourgeoisie are as different as chalk and cheese. As for investments, many of their requirements differ widely too. So do minimum allocation conditions. The former can enter the market with as little as ₹500 in mutual funds (MF); the latter, often driven by the zest to invest in pricey portfolio management services (PMS), must shell out at least ₹50 lakh for a single deal. The difference in ticket sizes could not have been starker. Waltzing into the wide chasm now comes the market regulator with a fairly novel idea: a new asset class (NAC) that suits the middle ground, complete with a minimum allocation of ₹10 lakh. And thereby hangs a tale.

The idea of NAC is captured in a consultation paper masterminded by the markets regulator. Aimed at bridging the gap between MF and PMS, the paper specifically refers to a couple of critical points:

- The market needs a regulated investment product featuring higher risk-taking capabilities and a higher ticket size.

- The proliferation of “unregistered and unauthorised” investment products must be arrested.

The two points, I must say, actually reflect the nation’s broadbased investment management landscape. There exists great diversity in terms of risk-reward dynamics, complexity of products, management styles, entry and exit barriers, minimum allocation requirements and so on. Among the products that occupy unique positions are MF and PMS.

The first, it is commonly believed, appeals more to ordinary, retail investors. The second — somewhat complicated in comparison — is usually associated with the wealthy. Incidentally, AIF or Alternative Investment Fund (more popularly, “alt”), also happens to be the playground of the well-heeled. For the record, an alt needs a minimum ₹1 crore.

The regulator in its latest move has in particular flagged certain players that assure unusually high returns. The lure of such returns — frequently unrealistic — tends to feed on people’s expectations. Many investors relentlessly aim at sharper yields, a pursuit that can result in great risks. NAC, the market watchdog has observed, will offer “a regulated and structured investment” suited to risk-takers.

New wine

The proposed category of assets, it appears from the first reading of the Sebi paper, will cater to a risk-return profile that stands between MF and PMS. It is also clear that the authorities have considered safeguards and risk mitigation principles.

A few pointers will help the reader appreciate the difference (between MF and PMS):

- There can be specific investment styles aimed at managing higher risk.

- Redemption frequencies can be customised to handle liquidity (“without imposing undue constrains on investors”).

- Only pre-defined strategies (that is, approved) can be offered to investors.

The regulator has actually outlined two model strategies. I find these models particularly interesting. A) Long-Short Equity Fund

A fund may aim at high returns by taking long and short positions in equity and equity-related instruments. For example, such a fund may hold positive views on pharmaceuticals and negative views on FMCG. So it may well allocate to both by going long on pharma and short on FMCG.

B) Inverse ETF/Fund

Negative correlation is the focal point in this case. These funds aim at high returns from negatively correlated assets. Incidentally, this has been sharply criticised by certain quarters.

I must mention here that Long-Short strategies are not uncommon in the domestic market. A professional investor is free to adopt long positions in underpriced assets, while selling short overvalued assets. Inverse ETF, however, will be a fairly new animal in the Indian investing space.

Not in an old bottle

Here are the other core features of the NAC: As mentioned at the outset, the minimum investment here has been pegged at ₹10 lakh. SIP (Systematic Investment Plan) and other switches will be allowed. I expect a number of asset management outfits to readily introduce this product (once it is green-lighted).

The regulator wants companies with a minimum track record of three years to be in the fray; each player must have an average AUM (assets under management) of ₹10,000 crore in the preceding three years.

As a secondary option, each fund management firm that wants to roll out NAC must engage a chief investment officer with a decade or more of experience in managing at least ₹5,000 crore. An additional fund manager must be tasked (minimum experience: seven years; minimum AUM: ₹5,000 crore) with the responsibility as well.

It also stands to reason that the regulator will approve only if no action has been taken against the Sponsor or the Asset Management Company during the past three years. Quite interestingly, Sebi has declared that there will be no need to segregate the two functions — that is, MF and NAC. Yet a well-enunciated distinction must be sustained in terms of advertising and branding.

Between MF and NAC, there will be several other differences too. A quick list.

- NAC can be a little more flexible than MF on the allocations front.

- Single issuer limit will be 20 per cent of Net Asset Value (NAV). For MF, this is 10 per cent.

- NAC can allocate 12 per cent of NAV in A-rated (or even sub-A) debt instrument. This limit stands at 6 per cent for MF.

- A high 20 per cent of NAV can be parked in REIT, that is, Real Estate Investment Trust. This is 10 per cent for MF.

- Risk for an MF investor is captured through “Risk-o-meter”, which is currently displayed widely. The reference is to pictorial depiction — a semi-circular meter with an arrow pointed towards a certain category of risk. As for NAC, this is expected to be demonstrated in the form of a risk band.

The writer is director of Wishlist Capital Advisors