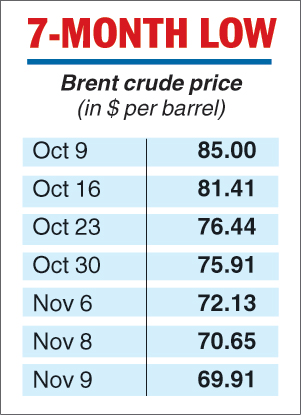

Brent crude oil sank on Friday to a seven-month low under $70 on surging US energy stockpiles ahead of a weekend meeting of major oil producing nations.

In London morning deals, benchmark oil contract Brent North Sea crude for delivery in January slumped to $69.13 per barrel, the lowest level since April.

New York's West Texas Intermediate (WTI) for December tanked to $59.28 to hit a February low.

The US benchmark had overnight entered a technical bear market, meaning that WTI has now lost 20 per cent from its most recent peak last month.

The fresh plunge comes as representatives from Opec and non-cartel members prepare to meet Sunday in Abu Dhabi to discuss a possible output cut to protect their revenues amid slumping prices.

Since hitting four-year highs last month, crude prices have slumped on rising production, Chinese economic growth fears and easing concerns about the impact of sanctions on Iran.

Sentiment took another hammering overnight after the US Department of Energy revealed soaring crude stockpiles, indicating weaker demand in top oil consumer the United States.

Washington's decision this week to grant waivers to eight countries, including China, India and Japan, from US oil sanctions on Iran, has helped also to push prices south.

“The recent drop in oil prices reflects a combination of factors,” Economist Intelligence Unit analyst Cailin Birch told AFP.

“For one, signs of slowing oil demand are beginning to appear; the rate of GDP growth in China is beginning to ease. Likewise, a spate of relatively weak corporate earnings reports in the US has raised concerns that the trade barriers will be damaging to many US firms.”

“Slower than expected growth in these two markets would translate into lower oil demand, and therefore prices,” Birch added.

On Monday, US President Donald Trump's administration re-imposed tough sanctions on Iran’s financial institutions, shipping lines, energy sector, and petroleum products. However, worries over oil supplies from Iran — which is the second biggest Opec producer after kingpin Saudi Arabia — have diminished somewhat.

“The US government's decision to grant waivers to some important importers of Iranian oil has reduced fears of a supply crunch from the Middle East,” said Birch.

The Abu Dhabi meeting is aimed at addressing the market slump with a view to protecting the precious revenues of producer nations.

However, CMC Markets analyst David Madden told AFP that the participants would likely refrain from any immediate action.

“The oil producers might talk about future production cuts as a way of stabilising the price, but the price needs to strike a balance.” Madden said.