Biocon on Monday said its subsidiary Biocon Biologics will acquire Viatris Inc’s biosimilars business for $3.35 billion (about Rs 25,000 crore).

Biocon Biologics (BBL) will offer $2.235 billion in cash and stock to Viatris and $1 billion in compulsorily convertible preference shares (CCPS). The preference shares are equivalent to 12.9 per cent of BBL. Biosimilars are clones of biologic drugs, which are derived from animal cells and micro-organisms.

BBL and Viatris are already jointly developing biosimilars and insulin drugs.BBL said its existing relationship with Viatris would help to maximise value from the transaction.

The deal will lead to operational efficiencies across the entire value chain.

A combination of Viatris’s biosimilars and its portfolio of 20 drugs would accelerate the company’s capability in the developed markets with a direct presence in the US, Europe, Canada, Japan, Australia and New Zealand, the Biocon subsidiary said.

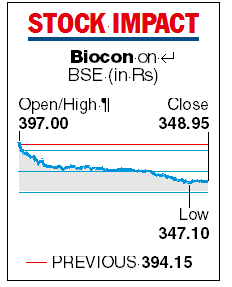

Stock markets reacted negatively because of concerns over the valuation of the deal. Shares of Biocon crashed 11.47 per cent or Rs 45.20 to settle at Rs 348.95 on the BSE.

“This acquisition is transformational and will create a unique fully integrated, world leading biosimilars enterprise. This strategic combination brings together the complementary capabilities and strengths of both partners and prepares us for the next decade of value creation for all our stakeholders,’’ Kiran Mazumdar-Shaw, executive chairperson, Biocon Biologics said. .

The transaction is expected to close in the second half of 2022, subject to the satisfaction of closing conditions, including certain regulatory approvals.

The companies will enter into a transition services agreement to facilitate a seamless merger.

Viatris will provide certain transition services to BBL, including commercialisation services, for an expected two-year period.

Viatris also will pay $50 million to BBL to fund certain capital expenditures.

The Biocon subsidiary will acquire Viatris’s commercial infrastructure in developed and emerging markets, the latter’s rights in all biosimilars assets including its in-licensed portfolios.

Biocon said it would infuse $800bn in equity in BBL to fund the deal. The rest will be financed by debt, additional equity or a combination thereof.

BBL has received expressions of interest from financial institutions for debt financing and equity commitments from existing shareholders, Biocon said. In 2020, Goldman Sachs and Tata Capital Growth Fund had invested in BBL.