According to Sebi, the CRAs need to review their rating criteria with regard to assessment of holding companies and subsidiaries in terms of their inter-linkages, liquidity, financial flexibility and support to the subsidiaries among others.

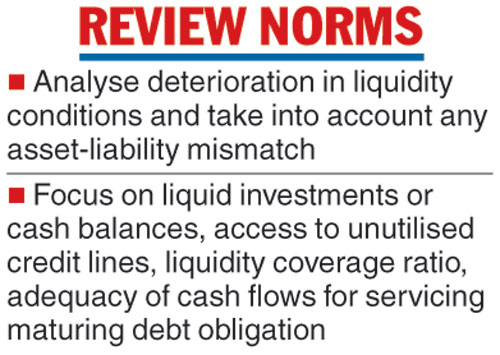

“While monitoring repayment schedules CRAs shall analyse the deterioration in the liquidity conditions of the issuer and also take into account any asset-liability mismatch,” the regulator noted.

Further, while reviewing “material events”, CRAs need to treat sharp deviations in bond spreads of debts vis-a-vis a relevant benchmark as a material event.

To strengthen the rating disclosures, Sebi said that if a subsidiary company gets support from the parent group or government, credit rating agencies will have to name the parent company or government that will provide support towards timely debt servicing.

The Telegraph

Market regulator Sebi on Tuesday asked credit rating agencies to analyse the deterioration in the liquidity conditions of the issuer and take into account any asset-liability mismatch while reviewing ratings.

Besides, Sebi has introduced a specific section on liquidity among key rating drivers that will highlight parameters such as liquid investments or cash balances, access to unutilised credit lines, liquidity coverage ratio, adequacy of cash flows for servicing maturing debt obligation among others.

The rating agencies will also have to disclose any linkage to external support for meeting near term maturing obligations, the Securities and Exchange Board of India (Sebi) said in a circular.

These measures will enable investors to understand underlying rating drivers better and make more informed investment decisions. The move comes in the wake of the Infrastructure Leasing & Financial Services (IL&FS) default, wherein the role of credit rating agencies (CRAs) came under the regulatory scanner.