The GST Council has a lengthy agenda at its 48th meeting — and possibly the last before the budget — on December 17 to be held in the virtual mode.

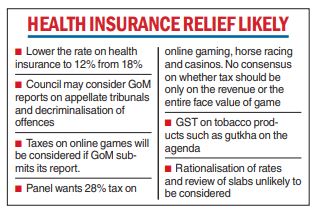

The council is likely to consider the reduction in the GST rate on health insurance, the setting up of appellate tribunals and the decriminalisation of offences.

Besides, it may consider the GST levy on casinos, online gaming and horse racing.

Officials said the council may consider lowering the rate on health insurance to 12 per cent from 18 per cent.

The insurance sector has long been demanding, especially in the wake of heightened medical concerns during and after the pandemic, the removal of the GST on health and term insurance or at least a rate less than 18 per cent.

The high rate is often cited as the main reason behind the low penetration of health insurance in the country.

The council could also consider the two reports by the group of ministers: one on appellate tribunals and the other on decriminalising offences.

Haryana deputy chief minister Dushyant Chautala-headed GOM has submitted its final report on the setting up of the Goods and Services Tax Appellate Tribunals (GSTAT).

The proposed tribunals will hear appeals against orders passed by commissioners and the appellate authorities and would comprise a president, two judicial members and one technical member each from the Centre and state.

The GOM on the levy of online gaming, horse racing and casinos is yet to submit its report. “If the report is submitted before the meeting, it will be taken up,” said a source.

The GoM is understood to be in favour of levying a 28 per cent tax on online gaming, horse racing and casinos but there is no consensus on whether the tax should be only on the fees or the entire consideration.

Karan Sachdev, partner, of Lakshmikumaran & Sridharan Attorneys, said the council is expected to consider the report of the GoM on the taxability of online gaming and casinos. Apart from the rate of tax, it is important to note whether the council recommends levying GST only on the revenue of the gaming company or on the entire face value of the game.

M.S. Mani, partner at Deloitte India, said: “The forthcoming GST Council meeting should consider the reports of the two GoMs on online gaming and capacity-based GST levy on certain tobacco products. Regarding online gaming, casino and related services, it is expected that clarity on both classification and rates would be discussed.”

“In respect of tobacco products such as pan masala and gutkha, a proposal to levy GST on a presumptive basis considering the capacity of the unit, would mean making changes to the basic structure of the GST and should ideally be avoided.”

The operationalisation of the GST tribunals, which would make the dispute resolution process more effective, could also be finalised at the meeting, he said.

Abhishek Jain, partner indirect tax, KPMG said the GoM reports on online gaming and appellate tribunal will be on the top of the agenda.

“Apart from this, as this meeting may be the last meeting before Union budget 2023, the council may also discuss certain tax rate changes and system reforms for ease of compliance. Further, the topic of GST rate rationalisation is likely to be picked up in the discussions.”

However, the rationalisation of GST rates and a review of the slabs seem unlikely as the GoM has not yet submitted its report. The Council would not take up the matter amidst inflationary pressure on the economy.