The Bharti Airtel stock crashed over 5 per cent on Monday as investors turned jittery over Gautam Adani’s decision to participate in the 5G auction.

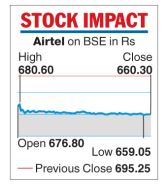

The Sunil Mittal-led firm saw its stock tumble 5.03 per cent, or Rs 34.95, on the BSE to end at Rs 660.30.

The Adanis on Saturday confirmed their entry in the race to acquire telecom spectrum. The auction will commence on July 26. However, the Ahmedabad-based Adani group said it was not targeting general users but will “provide private network solutions along with enhanced cyber security in the airport, ports and logistics, power generation, transmission, distribution, and various manufacturing operations”.

The group plans to use the airwaves for its data centres as well as the super app it is building to support businesses from electricity distribution and airports to gas retailing and ports.

“As we build our own digital platform encompassing super apps, edge data centres, and industry command and control centres, we will need ultra high-quality data streaming capabilities through a high frequency and low latency 5G network across all our businesses,” the conglomerate said in a statement.

Yet investors are worried that the arrival of Adani could disrupt the market.

They fear that though the group is not targeting mobile consumers, it could do so at a later stage by acquiring a domestic firm. This could not only bring a new player into the market but also derail the gains seen in recent months in the form of tariff increases.

Incidentally, while the Bharti Airtel counter ended in the red, the Vodafone Idea scrip settled with gains of 3.44 per cent to finish at Rs 8.72.

A source added that even if Adani targets enterprises, it will be a strong player in a segment expected to contribute around 40 per cent to 5G revenues.

According to a Motilal Oswal report, the Adanis could have simply leased network or spectrum from telcos to meet its telecom goals rather than participate in an auction.

“So, there exists a possibility of an expanded telecom foray over time. Even if the Adani group plans to foray into the mobility space, 5G spectrum (3,500Mhz, 26Ghz) alone may be unviable to offer its consumer’s network coverage. A pure 5G investment does not validate a full-fledged telecom foray.”