Bharti Airtel on Monday hinted at a tariff hike as it starts rolling out 5G services in the country.

Analysts said the tariff hike could be lower than last year in the range of 15 per cent.

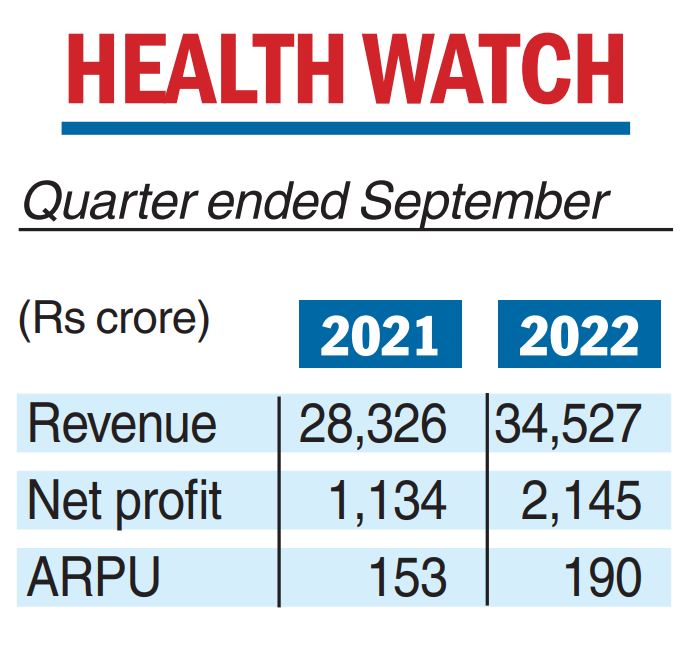

The telco posted an 89 per cent year-on-year rise in consolidated net profit for the second quarter ended September at Rs 2,145 crore amid improved average realisation per subscriber.

“We are now rolling out 5G and are confident that Airtel 5G Plus will deliver the best experience in India while being kinder to the environment.

“I do believe that 5G technology has the potential to bring tremendous innovation to India. At the same time, we remain concerned about the low ROCE (Return on Capital Employed) that our business delivers due to pricing that is the lowest in the world.

“Given the large investments required to drive digital adoption in India we believe there is a need for tariff correction,” Airtel CEO Gopal Vittal said.

Airtel 5G Plus goes live with in eight cities, with all urban and key rural areas covered by March 2024.

The company has paid Rs 8,312 crores for 5G spectrum to the Centre for four years — settled ahead of schedule to free up cash flow for 5G rollout.

After a span of two years, telecom companies in November last year hiked tariffs across some prepaid plans by 20-25 per cent. They expect them to be in the range of around 15 per cent.

Analysts expect telecom firms to announce tariff hikes by the end of fiscal 2023, having spent billions of dollars in the country’s recent 5G auction.

Rating agency CareEdge said aggregate debt of the major telecom service providers are likely to touch Rs6.20 trillion by March 2023, an increase of about 30 per cent from debt levels of Rs.4.73 trillion at the end of 2021-22.

After 40 rounds and seven straight days of bidding, the highly anticipated 5G spectrum auction concluded on August 1, fetching over Rs 1.50trillion, higher than the government’s expectations.

Airtel spent Rs 430.84 billion and launched its 5G services earlier this month. ARPU needs to be at Rs 200 and ultimately at Rs 300 for a financially healthy business model, Airtel said last November, when it raised tariffs.

Another reason for telecom companies to consider a lower tariff hike this time is the government’s relief on the spectrum usage charges, along with certain regulatory reforms introduced last year, analysts said.

Total revenue rose 22 percent year on year to Rs 34,527crore during the just-ended quarter, according to a statement. Average Revenue Per User (ARPU) for the quarter stood at Rs 190 as compared with Rs 153 in Q2 FY22.