A mid increasing market volatility, tightening of the central bank policy rates, and moderating growth, investors are actively looking to create resilient portfolios that have the potential to weather economic upheavals.

Allocating one’s investments to a singular asset class may not be the most prudent step in such times.

A diversified portfolio helps the investor spread risk across the spectrum and enable some downside protection in these troubling times.

Fixed income has an important role to play here as it is a diverse asset class that can provide opportunities to investors across the full market cycle.

Unfortunately, even seasoned investors tend to draw a blank when it comes to their understanding of this asset class. This unpopularity could largely stem from lack of awareness about the role of ‘fixed income’ strategies in an investor’s wealth creation journey.

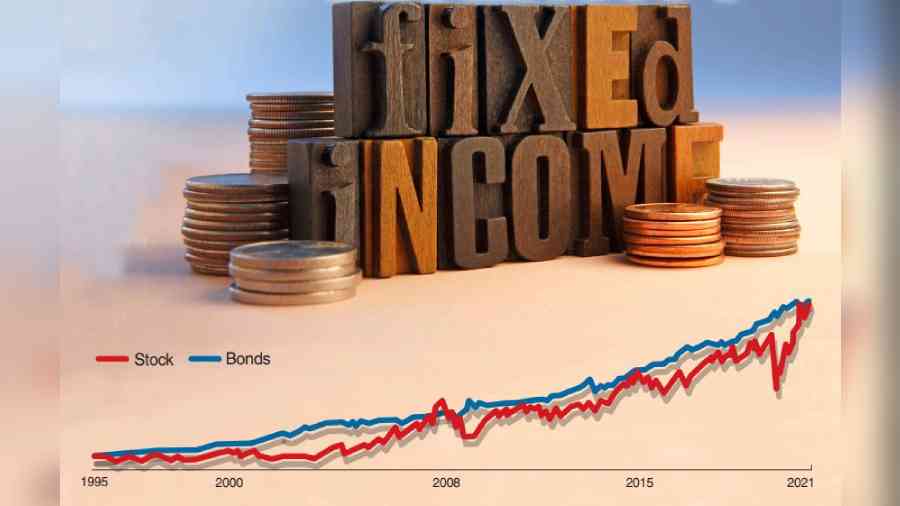

Now this poses a conundrum. Consider the chart that maps the performance of bonds since 1995. According to this, bonds have almost always outperformed stocks over the last 25 years. It is a clear indication of the opportunity that investors are yet to leverage.

Through this article, let us try to understand three important roles of fixed income strategies in an investor’s portfolio.

Capital preservation

Simply put, capital preservation is a practice adopted by investors to safeguard their capital in a portfolio.

Investors can opt for short-term instruments as they offer high liquidity and easier access to capital.

They can take comfort in the fact that the underlying securities are rated by external agencies, giving them an insight into the degree of risks associated with the said investment avenue.

With expectations of the rates further tightening in the upcoming cycles, investors could potentially consider fixed income assets to protect the absolute value of their investments.

Diversification

For long-term investing, asset allocation is key. Historically, different asset classes have been known to perform differently in various market cycles. Therefore, investing in two of more minimally co-related strategies can help investors mitigate risk and counterbalance the portfolio.

Fixed income strategies could play an instrumental role in acting as the bedrock for the creation of resilient portfolios that offer a sense of stability.

The ability of fixed income to act like ‘portfolio stabilisers’ is primarily the result of duration, which is a measure of the sensitivity of bonds to interest rates that tend to correlate with economic cycles.

This stability can enable an investor to rebalance, take advantage of market cycles, and consequently achieve long term investment goals.

Generating income

Yet another fundamental distinction for fixed income strategies is their potential to generate regular income as they are mostly coupon paying in nature.

Bonds are known to be relatively more predictable in terms of their income streams as long as the issuer remains solvent.

Furthermore, the steady and stable income flow in the form of interest payments from fixed income products allows the investor to plan his/her expenses well in advance.

Investor’s perspective

In the current macro environment, fixed income strategies have the potential to be an attractive entry point for several investors.

With the threat of inflation over us, investors are advised to look for options that would either maintain their value during inflation or at least increase their value over a specified period of time.

Fixed income strategies such as floating-rate bonds or short duration strategies can be adopted in the current market environment.

For investors with a 4-7-year investment horizon, the current yield curve presents material opportunities and also offers a margin of safety, given the steepness of the curve.

Investors can also decide between actively or passively managing their debt portfolios.

In fact, risk averse investors are encouraged to consider passive debt funds in their portfolios with pre-determined maturities.

Writer is co-head, fixed income, Axis Mutual Fund