It is barely 48 hours before Union Budget 2023 slips into history, a time when tax-payers are usually on pins and needles. Not without reason — even the most conscientious assessee wants to make full use of all tax benefits that the government allows them. The more aggressive ones of course hope, as they do before every budget, that the finance minister will grant a larger window for tax-saving purposes. A bit more by extending the scope of Section 80C, for instance, will not hurt anyone, they think.

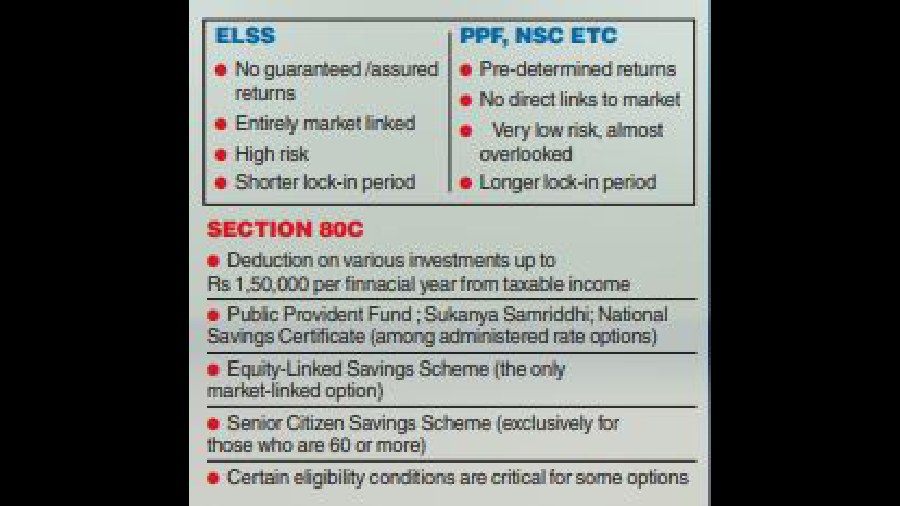

Yes, be that as it may, this is the last season for saving taxes under the same provision of the Income Tax Act for the current fiscal year. The choices before investors are limited insofar as tax-saving instruments are concerned. Usually, it is a tussle between ELSS, NSC and PPF. The first is market-driven, its performance is determined mostly by equity valuations. The other two are not so; investors know what is in store for them. Ditto for certain other small-saving instruments that provide administered-rate returns.

I will, for the sake of convenience, keep insurance plans away from the ambit of today’s discussion and limit this debate to the three options that have been mentioned specifically. Active investors, it can be safely argued, will prefer tax-saving funds. Their rationale is clear — ELSS can potentially deliver superior returns over a period of time. The latter, they know, is not necessarily three years, which serves as the mandatory lock-in period. This is indeed the shortest lock-in.

Speaking of being locked in, investors are also aware that the alternative is at least five years. Even for long-term tax-saving deposits, a similar five years is the obligatory lock-in.

The world of tax-saving funds, I must mention, is set to turn a bit more dynamic. Passive ELSS is an option that may yet become acceptable in the days to come. Here, fund managers will follow indices faithfully. There will be no attempt to beat the broad market — much unlike the current crop of actively-managed ELSS. The latter aim at providing alpha; higher the return, better is the delivery. That is how active managers work anyway all over the world.

Fixed rates?

Taking the narrative back to the likes of PPF and NSC, here are some points for investors to consider:

- With assured returns, the issue of uncertainty is addressed. This appeals to investors, especially the section that wants to stay away from the twists and turns of the securities markets.

- There is a sense of safety when it comes to options like NSC, which investors typically buy from the postal department. It is inconceivable that the government will not remain true to its commitment. Default in this category of investment is not even a factor to be considered.

- With higher rates of interest come higher satisfaction. For a large section of the investor community, smarter rates do mean a lot. The reference here of course is to the better rates that are being offered in certain cases these days. Inflationary trends have lately prompted the central bank to change its stance on policy rates.

The repo, for instance, has been adjusted several times in the recent past. The result is for all to see — rates have moved up all over the system. Deposits are fetching 8 per cent or even more in the banking sector. This has led to a surge in allocations too; a section of investors are again turning to deposits.

Smart choices count

The fact is that in the real world, smart choices will count. At the end of the day investors who want market-determined options can take up ELSS. Those who choose conservatism (and not aggressive strategies) will select PPF and NSC.

What should the average tax-paying citizen do? How should he confront the situation? In the context of this dilemma, I have a simple prescription to offer.

The individual investor should choose both — that is, both active management and fixed income. Try to get the best of both worlds, that is.

A solution like this will of course lead to the inevitable question: how will an investor split his tax-saving strategy? Will it be, for instance, a 60:40 mix, with the majority being invested in ELSS?

The answer, dear reader, is not for me to suggest. It will depend on your risk-tolerance. If you do not mind the risk (read: uncertain returns), then tax-saving funds should be your choice.

Exercising such a choice, mind you, will not be easy. There are so many tax-savers in the mutual fund market.

Each asset management company has an ELSS to offer. A few have indeed extended the idea of tax saving a bit — they have rebranded their products and introduced them with a “long term equity” spin. While these retain the basic flavour, the idea of staying only for three years is put to test.

That actually works in favour of ELSS investors who do not wish to exit immediately after the compulsory lock-in is over. Yes, it is quite possible to stay put for a fourth, fifth or sixth year if the investor so desires. Or even longer if conditions work in his favour.

The writer is director of Wishlist Capital Advisors

Form 16 glitch

In my Pan Card, my name is written in the right order, but in form 16, my middle name is written first, and then actual name followed by surname. My address also needs to be changed. What is the process of correction?

Ram Pada Chakraborty, email

Any changes related to Pan card can be made online at NSDL or UTIITSL or by filling up changes or correction in Pan data form and submitting the form at the Pan card application centres, the state wise list of which is available on the UTIIITSL website. Form 16 is provided by companies to their salaried individuals as information on tax deducted. The employees in turn can use form 16 while filing their tax return and compare the TDS by the employer with data available in the income tax TRACES portal. Now, if your Pan records are correct, then you may need to approach your employer to correct the name and address at their end so that it is reflected appropriately in the form 16.

SCSS extension

What are the rules and formalities relating to the extension of Senior Citizens Savings Scheme (SCSS) account? Also, is the interest in the extended period taxable?

JP Dutta, Calcutta

SCSS account holder may extend the account for a period of 3 years from the date of maturity by filling up the extension form and submitting the same with passbook at the concerned post office. The account can be extended within one year of maturity and once done, it will earn interest at the rate applicable on the date of maturity. The extension of the account can be made only once. Interest in the extended period will be taxable, as was the case in the initial 5-year tenure of the account. Only deposits made to the account are exempt under section 80C.

If you have any queries about investing, or taxes or a high cost purchase you are planning, mail to: btgraph@abp.in or write to: Business Telegraph, 6 Prafulla Sarkar Street, Calcutta 700001