Nabard has estimated a priority sector lending potential of Rs 2.70 lakh crore for Bengal in 2023-24, up 9 per cent from the previous estimate of Rs 2.47 lakh crore in 2022-23.

A category-wise break up of the credit potential shows the share of MSMEs the highest at 44.26 per cent followed by agriculture sector including agri-infrastructure and ancillary activities at 39.54 per cent.

Self-help groups and joint lending groups can absorb 7.69 per cent of loans and the housing sector 4.67 per cent.

The other sectors with potential are education, social infrastructure, export credit and renewable energy.

Unveiling the state focus paper for 2023-24 on Wednesday, Usha Ramesh, chief general manager, Nabard, said the state government has taken several initiatives for multi-dimensional growth.

“However, these initiatives have to be supplemented through adequate credit deployment and co-ordinated efforts of all stakeholders for a faster and holistic development of the state,” she said.

She also said small landholders representing 96 per cent of the entire farming community in the state are faced with challenges of low investment, poor productivity, inadequate post-harvest facilities and weak market orientation coupled with the adverse impact of climate change.

“Collectivisation of agricultural produce through Farmer’s Producer Organisations is imperative to leverage the economies of scale by conferring greater bargaining power, better market and price discovery, access to credit and insurance etc,” she said.

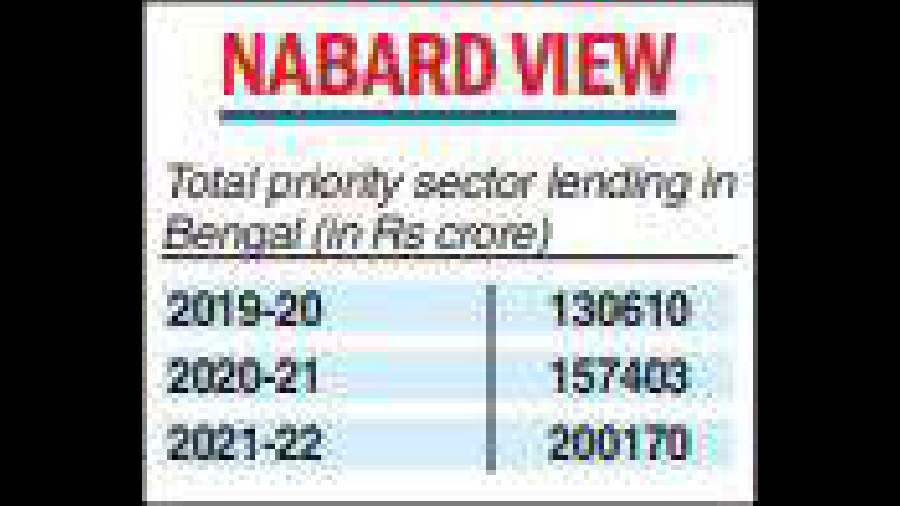

Total financial support extended by Nabard including refinance, direct finance and grants have increased from Rs 12,686.22 crore in 2019-20 to Rs 14,026.38 crore in 2021-22. As of January 4, 2023, Nabard’s financial support to the state was Rs 7149.95 crore.

Nabard on Wednesday also released a study on financial inclusion in Bengal.

The composite financial inclusion index shows Calcutta, Cooch Behar, Uttar Dinajpur, Murshidabad and Malda as the top five districts while Hooghly, Alipurduar, Jhargram, Kalimpong, South 24 Parganas, Purba Burdwan, North 24 Parganas and Howrah are on the lower side of financial inclusion.

Nabard also said that it is working towards strengthening rural financial institutions through the digitisation of primary agricultural credit societies.