The benchmark Sensex on Thursday slumped 359 points amid forward and options expiry and persistent foreign fund outflows.

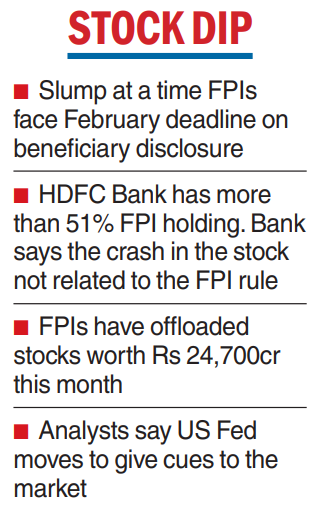

The selling by foreign portfolio investors (FPIs) has led to questions about whether it is on account of the enhanced disclosure norms prescribed by the Securities and Exchange Board of India (Sebi) that will come into effect from February 1.

The 30-share gauge fell 359.64 points or 0.51 per cent to end at 70700.67 points after tanking 741.27 points to touch 70,319.04 points.

HDFC Bank, which has a sizeable FPI holding, is one of the stocks that has been battered over the past week. On Thursday, the stock fell 1.04 per cent to Rs 1,440.70 on the BSE.

The FPIs are broken into two categories in the bank: Category I FPIs with 2,590 entities hold 322.86 crore shares or 49.19 per cent.

The biggest in this category is the Govt of Singapore with 15.23 crore shares or 2.32 per cent. Category II FPIs – numbering 237 – together hold 20.31 crore shares, or 3.1 per cent.

The lender told CNBC TV-18 that there is no evidence to suggest selling by FPIs was related to the Sebi circular. It pointed out that companies with no identifiable promoter will not be impacted by the market regulator’s rules.

Last year, after the Adani-Hindenburg saga, the market regulator tightened the disclosure standards for "high-risk" FPIs who have 50 per cent or more of their investments concentrated in a single company or a group and those whose overall holding in the Indian equity markets is over Rs 25,000 crore.

Sebi had estimated the rules would affect FPI assets under management of around Rs 2.6 lakh crore. FPIs affected by the Sebi rule have till February to reveal details or reduce their positions. Reports say they have another six months of grace period.

The fear is that FPIs who are unwilling to disclose their ultimate beneficiaries are now offloading stocks.

"FIIs have been mostly sellers in January. Going ahead the market is likely to consolidate further ahead of the US Fed interest rate decision on Wednesday where the Fed is expected to maintain the status quo and give some hint about rate cut timeline," according to Siddhartha Khemka, head — of retail research, at Motilal Oswal Financial Services.