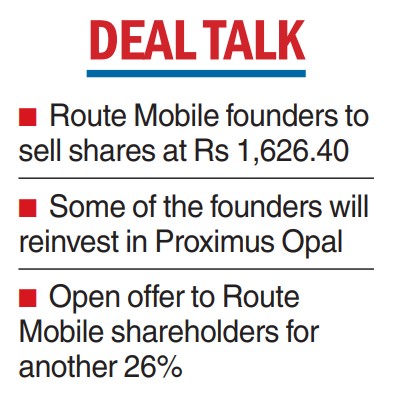

Belgium’s Proximus Group is acquiring at least a 57.56 per cent stake in Route Mobile the cloud communications platform service provider for Rs 5,922.4 crore. State-owned Proximus will buy the stake from the founding shareholders of Route Mobile.

Some of the founders will then reinvest into Proximus Opal (an arm of Proximus) which is executing the deal.

Proximus Opal is offering Rs 1,626.40 per share for the stake, a marginal premium to Route Mobile’s closing price of Rs 1,624.85 on the BSE last Friday. Proximus Opal will now make an open offer to acquire 26 per cent from the public at the same price.

The open offer is for the purchase of 1.64 lakh shares aggregating to a total consideration of Rs 2,675 crore.

Route Mobile offers omnichannel communication solutions to enterprises such as automated SMS or WhatsApp notifications for order updates, appointment reminders, promotions as well as voice-based and e-mail solutions.

The company also offers AI based firewall analytics solutions to mobile network operators worldwide.

A statement from the company said that depending on the response to the open offer, the stake held by Proximus Opal could further increase to 75 per cent of its equity.

“The acquisition of a majority stake in Route Mobile is a transformational step for our international CPaaS (communications platform as a service) and digital identity activities,” Guillaume Boutin, CEO of Proximus Group, said on the acquisition.

“With Route Mobile and Telesign, Proximus Group now holds two strong and highly complementary global assets, both from geography and product expertise standpoints. This will allow us to reap the benefits of scale, considerably reinforce the product suite of both brands and realize synergies generating substantial value for our shareholders.’’

At bourses, the shares of Route Mobile initially hit a 52-week high of Rs 1,759.50 on the BSE. However, the amount paid by Proximus led to disappointment among investors. Consequently, the Route Mobile scrip crashed 8.52 per cent to Rs 1,486.35 on the BSE.

“The partnership with Telesign (a group firm) paves the way for Route Mobile to become one of the global CPaaS leaders and achieve a billion-dollar annual revenue run-rate much sooner than the anticipated 3-4 years’ timeframe,’’ Rajdip Gupta, CEO of Route Mobile, said.

“Route Mobile, with its strong CPaaS omnichannel product offerings and deep entrenchment in emerging markets coupled with Telesign’s strong presence in developed markets and a very robust digital identity stack, complement each other immensely to create a very strong value proposition for the Proximus Group and its stakeholders,” Gupta said.