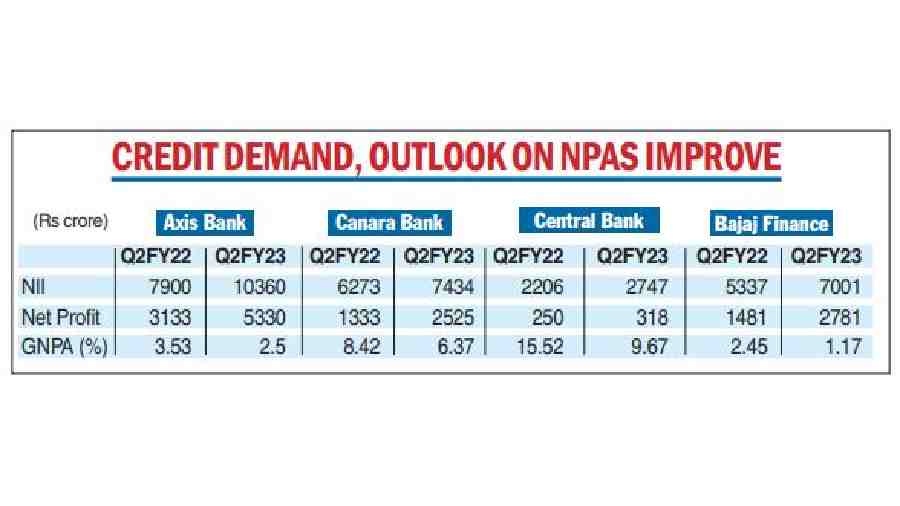

Lenders have posted good results in the second quarter of the fiscal amid rising credit demand and an improved outlook on stressed assets. “I am confident most of the banks will have a double-digit growth in credit,” L.V. Prabhakar, MD and CEO, Canara Bank, said.

Axis Bank on Thursday reported a 70 per cent yearon-year growth in net profit at Rs 5,330 crore for the quarter ended September 30, 2022.

Net interest income grew 31 per cent to Rs 10,360 crore. Net interest margin (NIM) for the quarter stood at 3.96 per cent, up 57 basis points from a year ago.

The strong growth in the bottomline was buoyed by a 22 per cent growth in retail loans, 28 per cent growth in SME loans and 49 per cent growth in mid-corporate loans highlighting an uptick in credit demand across borrowers.

Specific loan loss provisions during the quarter declined 19 per cent: gross nonperforming assets at 2.5 per cent fell 103 basis points and net NPA at 0.51 per cent was down 57 basis points.

Axis Bank said it holds cumulative provisions (standard plus additional other than NPA) of Rs 11,625 crore at the end of the second quarter. This is over and above the NPA provisioning.

“Over the past 12 months, we have made significant strides across every identified priority area…The core operating profits and margins have grown on the back of strong performance across business segments,” said Amitabh Chaudhry, MD & CEO, Axis Bank.

Canara net

State-owned Canara Bank on Thursday reported an 89.42 per cent rise in its net profit to Rs 2,525 crore for the second quarter. The bank had posted a net profit of Rs 1,333 crore in the same period of the previous fiscal.

Net interest income of the bank at Rs 7,434 crore during the quarter was up 18.51 per cent over Rs 6,273 crore. NIM for the quarter stood at 2.83 per cent against 2.72 per cent in the corresponding period previous year.

The bank’s gross NPA declined to 6.37 per cent of the gross advances compared with 8.42 per cent at the end of September 2021. Net NPA fell to 2.19 per cent from 3.21 per cent.

Canara Bank reported a 20 per cent growth in advances during the quarter driven by a 17 per cent growth in housing loan, 16.4 per cent rise in retail, agriculture and MSME (RAM) advances.

Central Bank

Public sector lender Central Bank of India on Thursday reported a 27.2 per cent jump in net profit at Rs 318 crore in the second quarter ended September 30, 2022. The lender had posted a net profit of Rs 250 crore during the same quarter of the previous fiscal.

Net interest income of the bank at Rs 2,747 crore during the quarter was up 24.52 per cent over Rs 2,206 crore. NIM for the quarter stood at 3.44 per cent against 2.97 per cent in the corresponding period previous year.

Bajaj Finance

Bajaj Finance on Thursday reported a consolidated net profit of Rs 2,781 crore for the quarter ended September 30, 2022, up 88 per cent compared with the same period in the last fiscal.

Net interest income has increased 31 per cent to Rs 7,001 crore. Consolidated assets under management rose 31 per cent to Rs 2,18,366 crore.