The Reserve Bank of India’s shock decision to raise the credit risk weights on personal loans by 25 percentage points has sent banks and non-banking finance companies (NBFCs) into a tizzy as they try to deal with a situation that threatens to crimp capital adequacy ratios, increase borrowing costs, and throttle growth rates.

Analysts said SBI Cards would be among the hardest hit by the rule change with RBL and Bajaj Finance also likely to be scalded by the changes.

Brokerages felt that the shadow banks would have to deal with a double whammy: they will not only have to deal with the blow to their capital ratios but also wrestle with higher borrowing costs as banks tighten credit lines.

On Thursday, the RBI raised the risk weightage on unsecured consumer credit given by commercial banks and NBFCs from 100 per cent to 125 per cent.

The risk weight against their credit card exposure was also increased by 25 percentage points to 150 per cent and 125 per cent for banks and NBFCs, respectively.

Analysts at Motilal Oswal said in a note that the Common Equity Tier-1 (CET1) capital level of SBI Cards — the credit card issuer which has the highest exposure to unsecured credit because of the nature of its business — will decline by 416 basis points.

“Our estimates suggest a 30-85 basis points impact on capital ratios (barring SBI Cards) on account of the increase in risk weight. Our calculations suggest the impact to be maximum for RBL/HDFC Bank/ICICI Bank at 84 basis points/72 basis points/64 basis points,” its analysts added.

The brokerage estimated that Axis Bank’s CET1 level would dip by 55 basis points, Kotak Mahindra Bank by 54 basis points, and SBI by 44 basis points. The CET1 level at Bank of Baroda would fall by a fairly modest 26 basis points while Punjab National Bank’s would dip by 34 basis points.

CET1 is part of a bank’s Tier 1 capital and it comprises equity or common shares, capital reserves, statutory reserves, revaluation reserves, other free reserves and balance in profit and loss account at the end of the previous financial year.

Analysts at CLSA expect a 230 basis points reduction in the Tier-1 capital of Bajaj Finance, while Citi estimated that the lender’s capital adequacy ratio (CAR) would be impacted by 190 basis points.

According to S&P Global Ratings, the RBI’s move will hit Indian banks capital adequacy levels by 60 basis points. It estimated the impact on Bajaj Finance at around 240 basis points after its recent capital hike.

JM Financial said in a note that among smaller NBFCs, Poonawalla Fincorp would witness an impact of 230-250 basis points on its Tier 1 capital.

Stocks tank

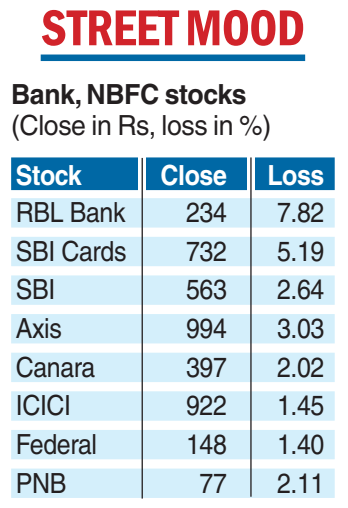

RBL Bank was the most hit as it fell 7.82 per cent to close at Rs 234.70 on the BSE after plummeting 9.45 per cent during intra-day trades to Rs 230.55. SBI Cards saw its stock falling 6.71 per cent to a day’s low of Rs 720.40. However, it recovered to close at Rs 732.15, a drop of 5.19 per cent.