Some Rs 11,000 crore of bad loans stands to be now classified as standard, according to bankers. Loans to the micro sector have grown by 22.3 per cent over the last year, loans to small businesses have grown 18 per cent and to the mid-sized firms by 7.2 per cent, compared with 12 per cent credit to big business. “This is phenomenal growth which cannot be sustained,” said bankers.

Though the NPA levels for small business remain within limits, the overall bad loan portfolio for the sector is rising.

Between September 2016 and September 2018, small businesses which can access loans of between Rs 1 crore and Rs 25 crore, NPA has risen from 10.6 per cent to 11.3 per cent during this period. While for mid-sized firms where the loan is between Rs 25 crore and Rs 100 crore the NPA levels have risen from 15.2 per cent to 18.4 per cent.

Public sector banks are worried that higher credit to the MSME sector could increase gross bad loans in the sector.

Bankers said they have brought this to the notice of the finance ministry, especially in the light of signals to step up lending to the sector.

“We are saying that we will continue lending but we need to be careful,” said the director of a Delhi-based PSU bank.

Earlier this month, the RBI had given into the central government’s demand and had agreed to allow restructuring of bad loans for the MSME sector.

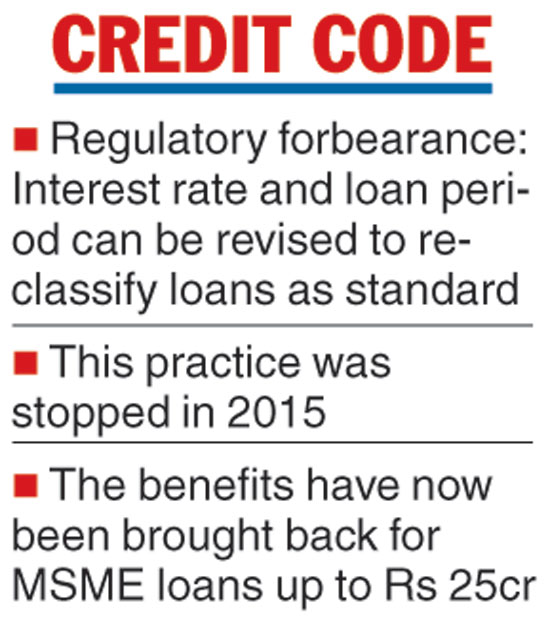

Conditions such as interest rates and loan period can now be revised to help reclassify as standard what would otherwise have turned into a bad loan.

Known as “regulatory forbearance” in banking, such restructuring was widely misused for ever-greening bad corporate loans in earlier years, till former RBI governor Raghuram Rajan stepped in to put an end to this practice in 2015.

The benefits were withdrawn for large corporate loans in 2015 but have now been brought back for MSME loans up to Rs 25 crore. Loans which are in default as of January 2019, but are not yet tagged as bad loans, can now be restructured under the new scheme.

The Telegraph