Banks continue to jack up their lending rates in line with the Reserve Bank of India raising its repo rates.

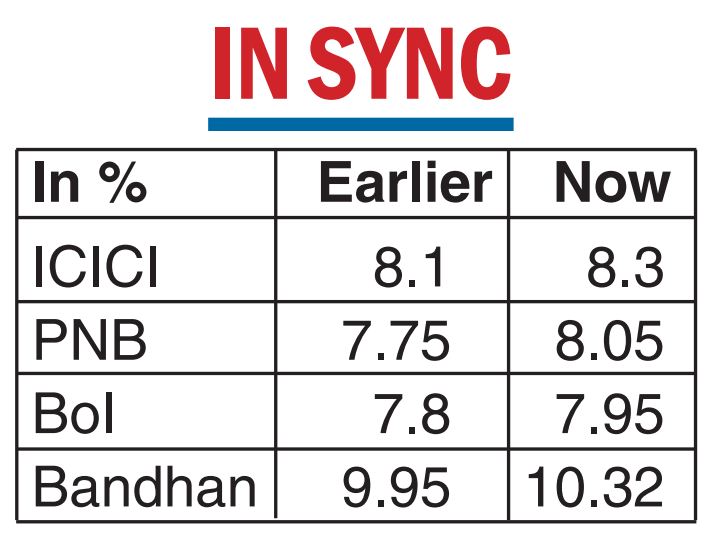

ICICI Bank, PNB, Bank of India and Bandhan Bank have revised their marginal cost of lending rate (MCLR) by 15-30 basis points.

Introduced in 2016, MCLR is the minimum rate at which banks can offer loans. Since October 2019, banks began to link floating rate products such as home loans to external benchmark rates such as the repo rate.

However, there are retail customers who continue to be under the MCLR regime. The RBI has increased the policy repo rate by 190 basis points (bps) in this year to combat elevated inflation.

It has resulted in banks raising their external benchmark-based lending rates (EBLRs) and MCLRs. Between May and September 2022, they increased their EBLRs by 140 bps and 1-year median MCLR by 70 bps.

According to the October bulletin of the RBI, the share of EBLR-linked loans stood at 46.9 per cent at the end of June, while the share of MCLR loans was 46.5 per cent.

ICICI Bank has raised its MCLR by 20bps, across all tenors with effect from Tuesday. Accordingly, one-year MCLR against which home and car loans are benchmarked stands at 8.30 per cent from the earlier 8.10 per cent, while it is 8.25 per cent for six-month MCLR.

PNB also announced that it is revising its MCLR from November 1. While one-year MCLR has been raised to 8.05 per cent from 7.75 per cent, it stands at 8.35 per cent (8.05 per cent) for the three-year tenor. The lender has effected a similar hike for other tenors as well.

Bank of India also made loans dearer for its customers when the one-year MCLR was upped to 7.95 per cent from 7.80 per cent, while six-month MCLR was hiked to 7.65 per cent from 7.55 per cent earlier.

Bandhan Bank has also made changes to its MCLR with effect from October 31. According to its website, one-year MCLR stands at 10.32 per cent, while three-year MCLR is at 11.10 per cent.

Digital currency

Nine banks on Tuesday traded Rs 275 crore in government securities using the central bank digital currency (CBDC) for the first time. The lenders traded in three bonds — 7.38 per cent 2027 security, 6.54 per cent 2032 bond and 7.26 per cent 2032 government security (GS).

While 24 trades were executed in the 2027 bond worth Rs 140 crore, there was one trade in 6.54 per cent GS for Rs 5 crore and 23 trades of Rs 130 crore for the other security.

The RBI has reportedly created a trading platform NDS-OM CBDC for the digital rupee.