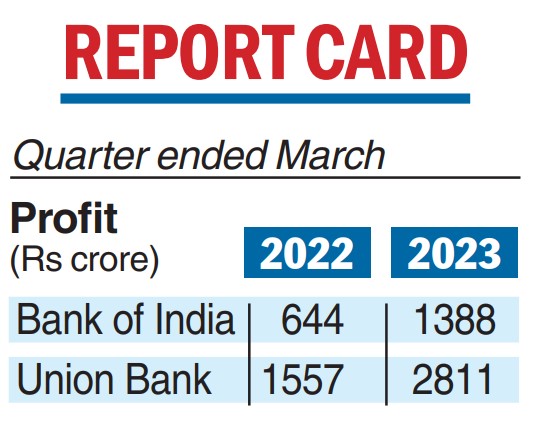

State-owned Bank of India on Saturday reported a 115 per cent jump in its consolidated profit after tax for the March quarter to Rs 1,388.19 crore, helped by a jump in other income.

The city-based lender’s profit for FY23 increased to Rs 3,882 crore from Rs 3,406 crore in FY22.

The bank is planning for a capital raise of Rs 4,500 crore in equity capital in FY24, which will help bring down the government’s stake in the lender to the Sebi-mandated 75 per cent.

The bank’s core net interest income was up over 37 per cent to Rs 5,493 crore on a 13 per cent growth in advances. It posted a widening of net interest margin to 3.15 per cent from 2.56 per cent in the year-ago period.

Its non interest income almost doubled to Rs 3,099 crore for the reporting quarter from Rs 1,587 crore a year ago.

Union Bank

Union Bank of India on Saturday reported an 80.57 per cent jump in March quarter net profit at Rs 2,811 crore, helped by a huge jump in recoveries from written-off accounts.

The state-owned lender’s net profit in entire 2022-23 was Rs 8,512 crore against Rs 5,265 crore a year ago.

In the March quarter, core net interest income increased 21.88 per cent to Rs 8,251 crore on the back of 13 per cent growth in advances and widening of net interest margin to 2.98 per cent from 2.75 per cent in the year-ago period.

JSW Energy, SECI ink pact for wind unit

New Delhi: JSW Energy has signed a power purchase agreement with Solar Energy Corporation of India Ltd (SECI) for wind projects totalling 300 MW.

The PPA is signed for supply of power for a period of 25 years with a tariff of Rs 2.94 per kilowatt (KWh), JSW Energy said in a statement on Friday.

“JSW Renew Energy Three, a wholly-owned step-down subsidiary of JSW Energy, has signed a PPA with SECI for 300 MW ISTS-connected wind power projects awarded under SECI Tranche-XII,” it said.

The projects are located in Maharashtra and expected to be commissioned in the next 24 months, the company said.

The company has set a target to reach 20 GW capacity by 2030 and 10 GW by 2025.

PTI