Deposit mobilisation could emerge as a challenge to lenders amid shrinking liquidity and a need to protect their margins. In the current competitive banking sector, an increase in rates may fetch more deposits to banks, but will put pressure on the net interest margin and hence the lenders’ bottom line. Speaking at a CII-organised event on Friday, SBI managing director C.S. Setty said that while banks were fairly comfortable in terms of asset quality and capitalisation, they are facing pressure to mobilise deposits.

“We had tremendous growth in deposits in the last two years coupled with low credit growth and the system liquidity was much more comfortable,” said Setty. He said a present challenge to lenders in general and banks, in particular, is addressing competition on the deposit side without putting pressure on the margins.

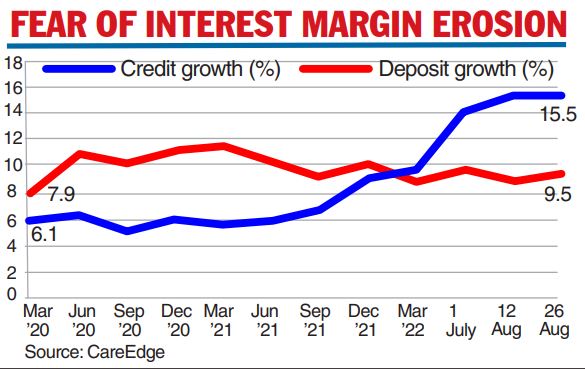

“There is only an extent to which we can increase the rate of interest,” Setty said. The banking system has been sustaining a liquidity surplus since the initial months of FY20 because of the faster build-up of deposits vis-avis credit disbursement (see chart). The trend got reversed in the last few months: liquidity is now lower with the RBI raising rates to manage inflation.

“The widening gap between deposit and credit growth may lead to supply-side issues thereby eventually constraining credit growth,” said Care Edge in a report on the banking sector. Total deposits stood at Rs169.9 lakh crore for the fortnight ended August 26, 2022, registering a growth of 9.5per cent year-on- year. Credit off take continues to witness a higher growth at 15.5 per cent for the fortnight.

The credit-deposit ratio rising since October, stood at 73.3 per cent for the fortnight ended August 26, 2022, up around 380 basis points over a similar period last year.

Setty said it was difficult for the central bank to manage currency when the dollar index has touched an all-time high in 20 years. The panelists at the CII session included Prashant Kumar, MD and CEO of Yes Bank and Rajiv Anand, deputy MD of Axis Bank.