A scaleback in provisions amid improving asset quality and collection efficiency has resulted in a multifold jump in net profit of Bandhan Bank for the quarter ended March 31, 2022.

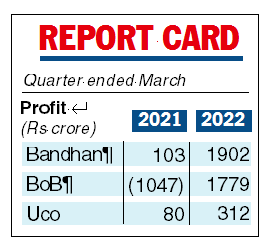

The net profit of the bank was Rs 1,902.3 crore compared with Rs 103 crore in the corresponding previous period. The bank’s provisions (other than taxes) fell drastically by 99.7 per cent on a year-on-year basis to Rs 4.7 crore compared with Rs 1,507.7 crore for the corresponding period of 2020-21.

The asset quality of the bank has improved with the gross NPA ratio as of March 31 at 6.46 per cent compared with 10.81 per cent as of December 31, 2021, and 6.81 per cent as of March 31, 2021.

Bandhan Bank MD & CEO Chandra Shekhar Ghosh told The Telegraph that a combination of improving collection efficiency, asset quality, and higher disbursement during the quarter have led to a better financial performance of the bank.

Bank of Baroda

Bank of Baroda (BoB) has posted a net profit of Rs 1,779 crore for the quarter ended March 31, 2022 against a loss of Rs 1,047 crore during the corresponding quarter previous year. The asset quality of the bank has improved with the gross NPA ratio as of March 31, 2022, at 6.61 percent compared to 8.87 percent as of March 31, 2021.

The bank’s net interest income grew 21.2 per cent to Rs 8,612 crore from Rs 7,107 crore in the corresponding period the previous year.

Uco Bank

Uco Bank on Friday posted a net profit of Rs 312.18 crore for the March quarter of 2022, an almost three-fold jump from Rs 80.03 crore a year ago, aided by an improving asset quality and lower provisions.

The bank’s gross nonperforming asset ratio as of March 31 was 7.89 per cent against 9.59 per cent in 2021.